The first step in getting ready for 2024 begins by reflecting on the major events that occurred in 2023. At the start of the year, the biggest challenge in the financial world was the high inflation rate. Following a year full of ups and downs, investors are now closely monitoring when the Federal Reserve might cut interest rates.

As the year draws to a close, this article will revisit the top 10 key economic events of the year, spanning from geopolitical tensions, central bank actions, to technological breakthroughs. By revisiting these notable developments and black swan events in the financial domain, this review aims to assist investors to plan comprehensive trading strategies for the upcoming year.

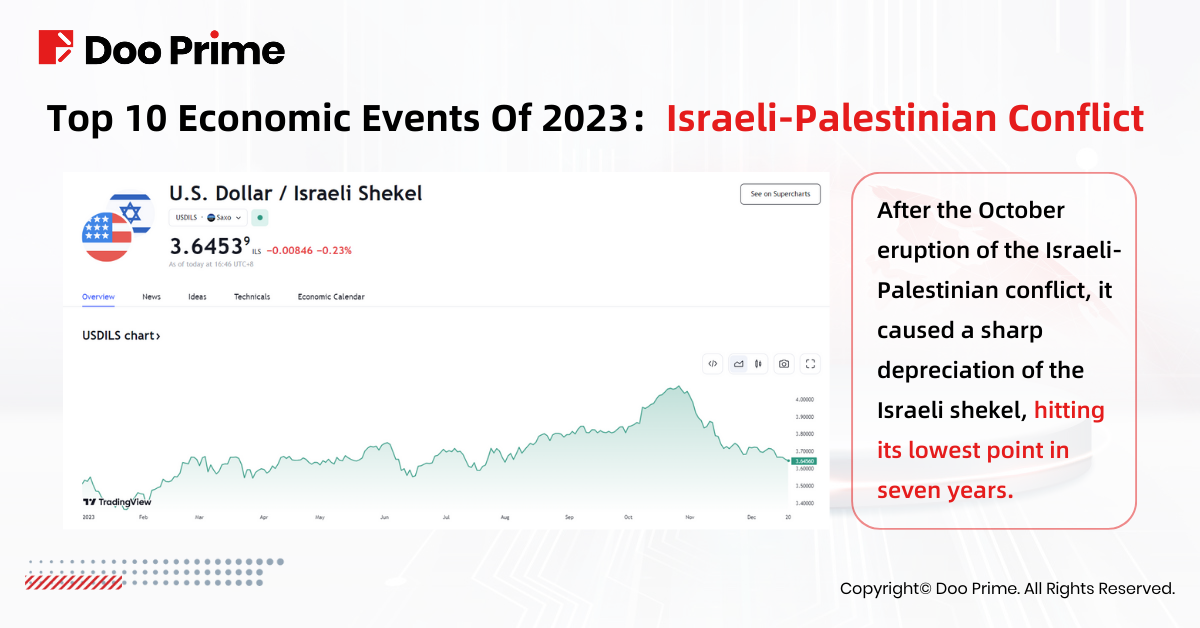

Israeli-Palestinian Conflict

The most significant black swan event of 2023 was the eruption of the Israeli-Palestinian conflict in October. This geopolitical tension led to a sharp depreciation of the Israeli shekel, plunging to its lowest point in seven years. Additionally, gold, viewed as a safe-haven asset, surged significantly in the short term. Investors’ bullish sentiment towards oil also intensified, propelling international oil prices to spike at USD 95 per barrel.

As of now, the Israeli-Palestinian conflict remains unresolved, with both sides’ offensives expanding to Gaza and the Red Sea. To avoid attacks, commercial ships have opted to take alternative routes, posing a risk of potential closure for the Suez Canal. Given this scenario, shipping costs are expected to substantially increase, potentially causing further escalation in oil prices. However, conversely, shipping stocks have received positive forecasts.

The AI Wave

Since the debut of ChatGPT at the end of last year, a surge of AI has swept across the globe. Tech giants are fiercely competing in the AI race, and stocks related to this field have seen a tremendous surge in value.

Google’s chatbot, Bard, was the first to report its performance. However, due to the product’s incomplete state, an error during a promotional video demonstration caused Google’s stock price to plummet by over 10% overnight. Nonetheless, Google redeemed itself in December by releasing Gemini, regarded as the “largest and most capable AI model.” Its overall performance not only surpassed human experts but also outpaced ChatGPT, earning high market expectations.

Leading the charge in the rapid advancement of the AI wave is Nvidia. Positioned as the “engine of the AI world,” Nvidia dominated the market with its flagship chips, witnessing its stock price surge from USD 149 at the beginning of the year to a peak of USD 493.

And how has the trend-setting ChatGPT performed this year? OpenAI partnered with Microsoft to create Copilot. With Microsoft’s investment in OpenAI, ChatGPT continues to evolve, with rumors suggesting the release of GPT-4.5 around Christmas time. Microsoft’s successful integration of OpenAI’s technology into products like Bing and Microsoft 365 led to a historic high in its stock price in November.

The Nasdaq 100 Special Rebalancing

Due to the AI boom in 2023 and the remarkable performance of tech stocks, the magnificent seven in the Nasdaq 100—Microsoft, Apple, Alphabet, Nvidia, Amazon, Meta, and Tesla—have exceeded a 50% weighting. To comply with the diversification regulations of the U.S. Securities and Exchange Commission (SEC), Nasdaq took an unprecedented step of a ‘special rebalancing’ of the index, ensuring that their total weight in the index does not surpass 40%.

Silicon Valley Layoffs

Despite the surge in tech stocks driving the market this year, many tech giants faced growth hurdles at the beginning of 2023. To cut costs and enhance efficiency, several major tech companies in Silicon Valley underwent significant layoffs.

In January, Amazon announced an anticipated layoff of 18,000 employees, marking the largest scale of layoffs among major tech companies to date. Similarly, Microsoft declared a layoff of 10,000 employees by March 31, possibly reducing its recruitment by up to one-third. During the same month, Google announced layoffs affecting 12,000 employees.

Following in March, Meta initiated a new round of layoffs affecting around 10,000 employees, simultaneously closing an additional 5,000 vacant positions. Another tech giant, Apple, although refrained from layoffs, froze hiring for multiple job positions and announced a delay in issuing some bonuses.

Bank Failures In The United States

However, the most alarming news this year was not the wave of layoffs but the cascade of bank closures in the United States.

On March 10th this year, the California Department of Financial Protection and Innovation (DFPI) announced the closure of Silicon Valley Bank, which was taken over by the Federal Deposit Insurance Corporation (FDIC). On March 12th, Signature Bank was also closed by New York state regulators, similarly taken over by the FDIC, establishing Signature Bridge Bank as a transitional institution. Meanwhile, Credit Suisse postponed the release of its 2022 financial report, causing panic and a stock market plunge. However, following intervention by the Swiss government, UBS purchased Credit Suisse, which was deeply embroiled in the crisis, for 3 billion Swiss francs, averting a collapse.

On May 1st, First Republic Bank also collapsed, marking the second-largest bank failure in U.S. history, aside from Washington Mutual’s collapse during the 2008 financial crisis.

Within a short two months, the closure of three regional banks, along with another bank teetering on the brink, led to a significant downturn in bank stocks.

The United States Debt Crisis

In January this year, the U.S. government’s debt reached nearly USD 31.4 trillion, once again nearing the legal debt limit. To cope, the Treasury Department took “emergency measures,” halting further borrowing. However, there was disagreement between the two political parties about raising the debt limit, causing a deadlock. Treasury Secretary Janet Yellen warned that if Congress didn’t raise the debt ceiling, the government could face a debt default as early as June 1.

Eventually, on May 27th, the two parties “principally agreed,” resolving the debt crisis. Yet, due to the worsening financial situation in the U.S., Fitch Group downgraded the U.S. credit rating from AAA to AA+, marking the first downgrade since 1994. The outlook shifted from negative to stable.

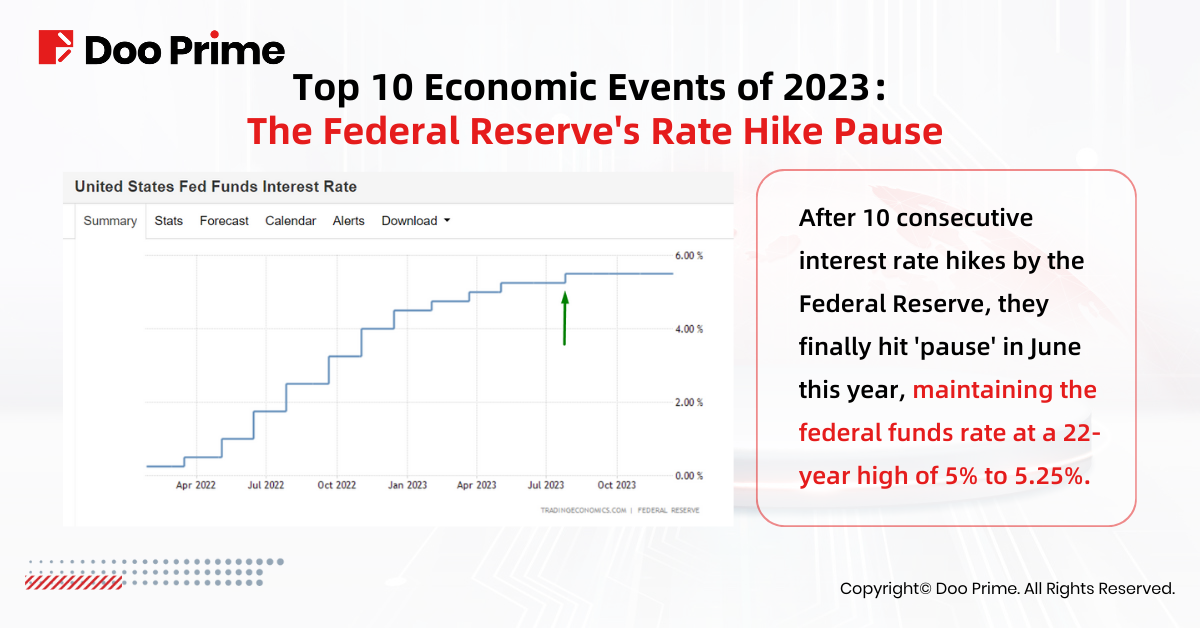

The Federal Reserve’s Rate Hike Pause

The layoffs in tech companies, U.S. bank collapses, and the mounting U.S. government debt are all linked to the Federal Reserve’s prolonged aggressive rate hikes. After a streak of 10 consecutive rate increases, the Fed finally hit the “pause” button in June this year, maintaining the federal funds rate at the 22-year high of 5% to 5.25%. The Fed’s decision to halt rate hikes signaled a strong hawkish stance, with claims of two more rate hikes within 2023. Market interpretation labeled this move as a “hawkish pause”.

Bank of Japan Leadership Change

In April of this year, the Japanese government decided in a cabinet meeting to appoint Kazuo Ueda to succeed Haruhiko Kuroda as the 32nd Governor of the Bank of Japan, with a term of five years. This marks the tenth time that Japan has changed its central bank governor.

At 71 years old, Kazuo Ueda is the first scholar in the history of the Bank of Japan to become its Governor. His academic background equips him to rationally assess how to reshape monetary policy without long-term reliance on the current stimulus mechanisms.

The United Auto Workers Strike

In September this year, around 12,700 workers initiated a collective strike after the United Auto Workers (UAW) failed to reach new labor agreements with General Motors, Ford, and Stellantis. It was the first time in UAW history that such a strike targeted all three major U.S. automakers, marking one of the most robust strike actions in the U.S. in recent years.

Following agreements with Ford and Stellantis, on October 30th, UAW also reached a tentative deal with General Motors, formally ending the six-week strike that had cost the automotive industry billions of dollars.

The Windsor Framework between U.K. and the EU

The United Kingdom and the European Union achieved a significant breakthrough in February this year by reaching the “The Windsor Framework”. The U.K. eased regulations on inspecting traded goods, while the EU also made corresponding concessions regarding jurisdiction in Northern Ireland, resulting in a relaxation of the previously tense bilateral relationship. The Windsor Framework respects and safeguards the respective markets and lawful interests of both parties, actively promoting bilateral trade interactions.

Embrace Opportunities, Manage Risks

The year 2023 was undoubtedly filled with challenges and changes. While the market faced much uncertainty, it also held endless possibilities. For investors, each event presents both a crisis and an opportunity. By practicing careful risk management, investors should closely monitor macroeconomic developments to seize the best opportunities. We look forward to the global economy finding a new balance and achieving more positive growth in the coming year.