What Is The Outlook For Stocks, Bonds, And Currency As The Federal Reserve Takes A Hawkish Pause?

On June 15th, the U.S. Federal Reserve announced a significant development in its interest rate policy. After a series of ten consecutive interest rate hikes since 2022, the Fed finally decided to take a hawkish pause and keep the federal funds rate within the 5% to 5.25% target range.

This move was accompanied by a strong hawkish signal, indicating the possibility of two more rate hikes in 2023, with a potential 25 basis point increase in July. Termed as a “hawkish pause,” this decision raises questions about how the stock, bond, and currency markets will be affected.

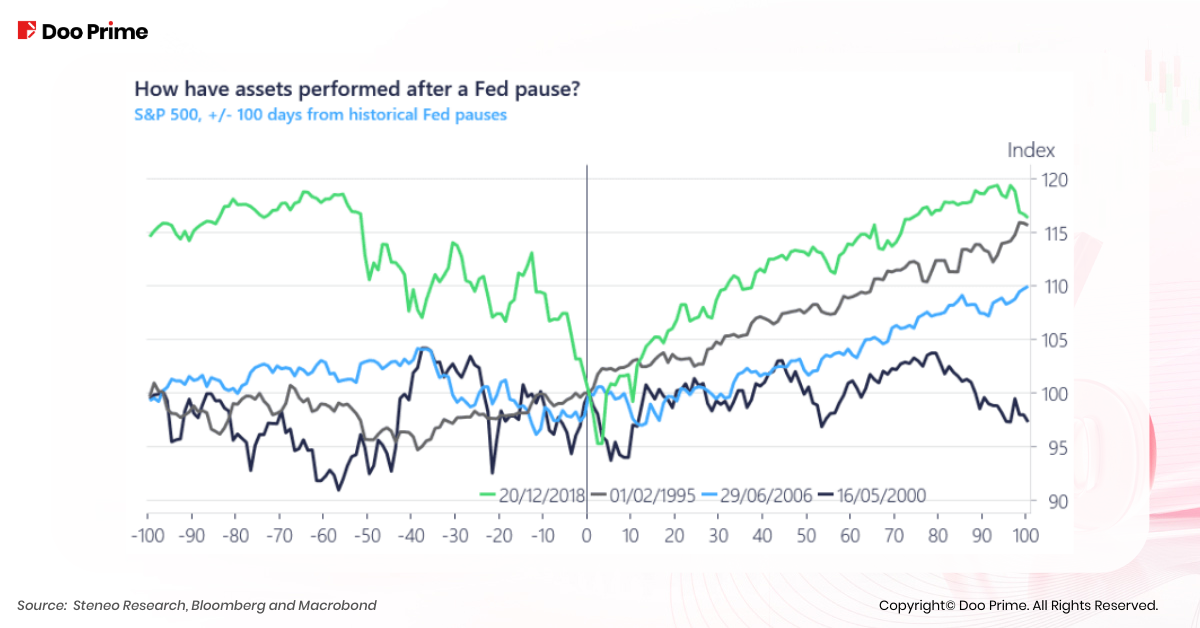

Looking at the historical adjustments of monetary policy by the Fed, pausing rate hikes tends to benefit the U.S. stock market, while rate increases lead to higher bond yields and a stronger dollar. How will this “hawkish pause” by the Fed affect the trends of stocks, bonds, and currency markets?

In this article, we delve into economic indicators and expert commentary to analyze potential market trends in these markets during the suspension and resumption of interest rate hikes, providing valuable insights for investment opportunities.

U.S. Stocks: Market Volatility Persists Despite Fed’s Hawkish Pause

Typically, U.S. stocks tend to rise during a pause in rate hikes, but they often experience significant turbulence once the rate hikes are resumed. The Federal Reserve’s decision to pause its hawkish stance presents a dilemma for investors. They need to navigate how to capitalize on the potential gains in U.S. stocks while protecting themselves against a possible pullback in the market.

- U.S. Stocks React With Brief Decline

In general, the Fed’s decision to pause interest rate hikes is perceived as a positive sign for the market, which favors higher U.S. stock prices. However, following the recent announcement of the interest rate resolution, U.S. stocks briefly dipped to daily lows.

The S&P 500 and Nasdaq declined, while the Dow dropped by nearly 430 points or more than 1% at one point. This counterintuitive market behavior is mainly due to the fact that 12 out of the Fed’s 18 voting members anticipate two more rate hikes this year. Additionally, Fed Chairman Jerome Powell has expressed a hawkish stance, stating that no officials believe rates should be cut this year.

- U.S. Stocks Rally Despite Fed Rate Hike Expectations

When the market expects the Federal Reserve to raise interest rates again, investor sentiment tends to become more volatile, leading to more cautious trading and a potential decline in U.S. stock prices. However, surprisingly, by the end of the 15th, U.S. stocks managed to recover from their losses, and the three major stock indexes collectively closed higher.

In fact, U.S. stocks have been on a rally in the first half of 2023, with the technology-based Nasdaq index recording a nearly 30% increase for the year. The surge in AI-related tech stocks has significantly boosted U.S. stocks, even in the face of the Federal Reserve’s intentions to raise interest rates throughout the year. This indicates that investors remain undeterred from entering the market.

According to Goldman Sachs analyst David Kostin, the potential profit growth from artificial intelligence (AI) has expanded the upside potential for U.S. stocks. Zhiwei Ren, a portfolio manager at Penn Mutual Asset Management, shares a similar view, stating, “Macro events don’t matter because AI is seen as a game-changing force.”

Citigroup’s model reveals that macroeconomic factors now have a reduced impact of 71% on the stock market, down from 83% since March. The attraction of AI-related technology stocks has enticed many investors who had previously left the market to return, and bearish investors have been forced to reverse their strategies due to the fear of missing out (FOMO). Overall, the upward trend in U.S. stocks is expected to continue in the near term.

Bond Market: Yield Curve Inversion And Hawkish Pause Impact

In the realm of the bond market, a temporary pause in interest rate hikes exerts a downward pressure on bond yields, consequently driving bond prices higher.

Conversely, the advent of a rate hike sends ripples of negativity through the bond market, as borrowing costs escalate, bond yields surge, and prices begin to falter.

Bonds encompass a spectrum of long and short terms, and a healthy yield curve typically exhibits higher long-term yields compared to short-term yields. However, an inverted yield curve suggests a market expectation of potential recession looming on the horizon.

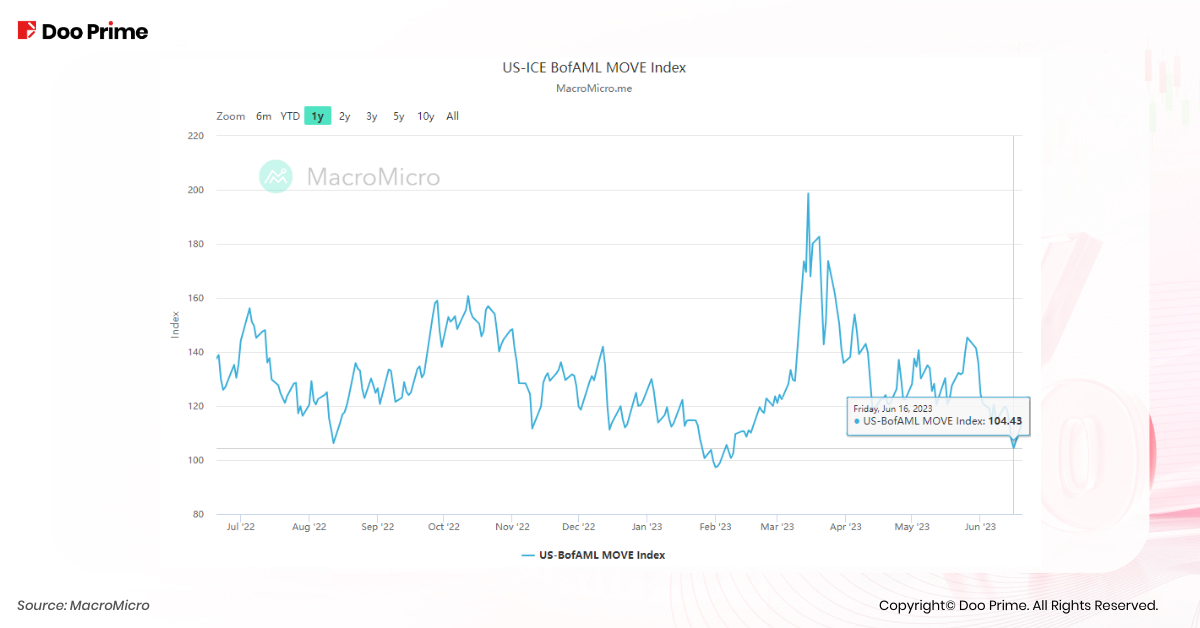

Following the Federal Reserve’s announcement of a pause in rate hikes, the Merrill Lynch Option Volatility Estimate (MOVE) index, a reliable gauge of anticipated volatility in U.S. Treasuries, descended to 104.43 on June 16th, nearing its lowest point preceding the onset of the Fed’s tightening cycle. This trajectory signifies a stable bond market sentiment and mitigates the likelihood of a sell-off.

Historically, the MOVE index and the U.S. 10-year bond rate have exhibited a positive correlation for the most part. However, following the resolution announcement, while long-term U.S. bond yields experienced a marginal decline of 3.80%, short-term U.S. bond yields. This move possess a heightened sensitivity to interest rate fluctuations, and witnessed a temporary surge of 17 basis points.

The Federal Reserve’s hawkish signal subsequently widened the gap between 2-year and 10-year Treasury yields to over 90 basis points, further deepening the inversion of the U.S. bond yield curve. The resumption of rate hikes may instigate a rise in 10-year U.S. bond yields, but the present state of the U.S. bond market is entangled in complexities.

With the U.S. national debt surpassing the monumental milestone of USD 32 trillion on the 15th, the country finds itself compelled to issue a substantial volume of U.S. debt to offset the gargantuan fiscal deficit.

This surge in U.S. debt issuance precipitates an escalation in short-term financing rates, further exacerbating the inversion of the yield curve and amplifying the signal of an augmented risk of recession on the horizon.

Currency Market: Navigating Divergent Central Bank Actions

The recent interest rate decisions by global central banks have revealed a remarkable divergence in their approaches. While the Federal Reserve opted for a hawkish pause, the Chinese central bank embarked on interest rate cuts, while the European Central Bank persisted in raising rates. These contrasting actions directly impact the exchange rate of the dollar.

In simple terms, suspending interest rate hikes tends to have a negative effect on the dollar, whereas resuming them generally strengthens the currency. However, based on the Federal Reserve’s previous rate hike patterns, the dollar experiences a period of suspension and subsequent decline before the actual resumption of rate hikes, followed by a subsequent rise.

The direction of the dollar upon the actual restart of interest rate hikes becomes uncertain, as it is influenced not only by domestic factors but also by the monetary policies pursued by other central banks.

Following the announcement of the latest Federal Reserve resolution, the dollar index experienced a modest uptick of approximately 60 points in the short term. It is anticipated that the dollar will maintain its resilience in the near future, gradually weakening only in the month preceding the first rate cut.

The Wisdom Of Fear And Greed In The Market

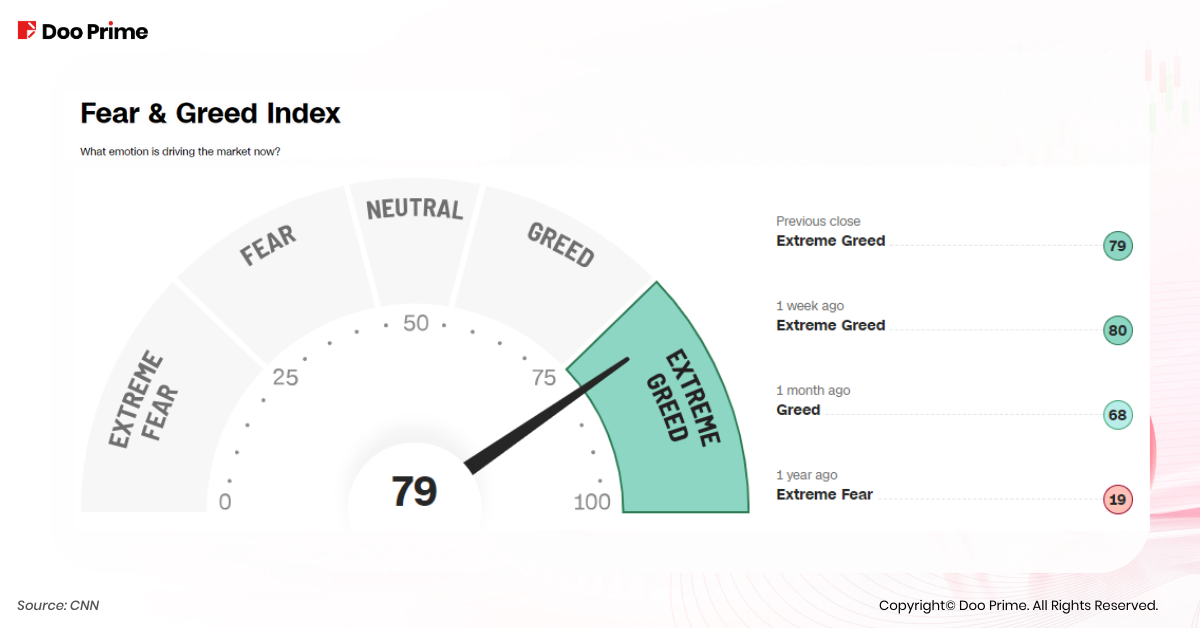

Warren Buffett once said that it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.” The Fear & Greed Index, a comprehensive measure of market sentiment, has recently climbed to 79, indicating an increased level of investor greed. However, crossing the threshold of 90 signifies over-optimism and the potential for market overheating.

Despite the Federal Reserve’s pause in rate hikes, key indicators like U.S. stocks, bond volatility, and the U.S. dollar index have returned to pre-hike levels. The surge in AI-related technology stocks has disrupted the typical trajectory of U.S. stocks. The U.S. bond market faces complexity due to high debt and a deepening yield curve inversion. The future direction of the dollar depends on the monetary policies of global central banks.

Amidst the current optimistic market trend, it is crucial for investors to remain vigilant to the extremes of market sentiment in a complex and volatile environment. It is essential to carefully assess potential risks and approach trading with caution.

As of this published piece, the CME FedWatch Tool indicates a 76.9% probability of a 25 basis point Fed rate hike in July. With the impending rate resolution, it will be interesting to observe how stocks, bonds, and currencies respond to the anticipated changes.

|About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.