Hurricanes Milton and Helene have unleashed catastrophic forces on significant parts of the United States, with Hurricane Milton in particular, poised to mark a historic level of destruction as it approaches Florida. This article explores the far-reaching impacts on various sectors, including the airline, insurance, and real estate industries, along with the broader economic implications.

Hurricane Milton: A Category 4 Menace

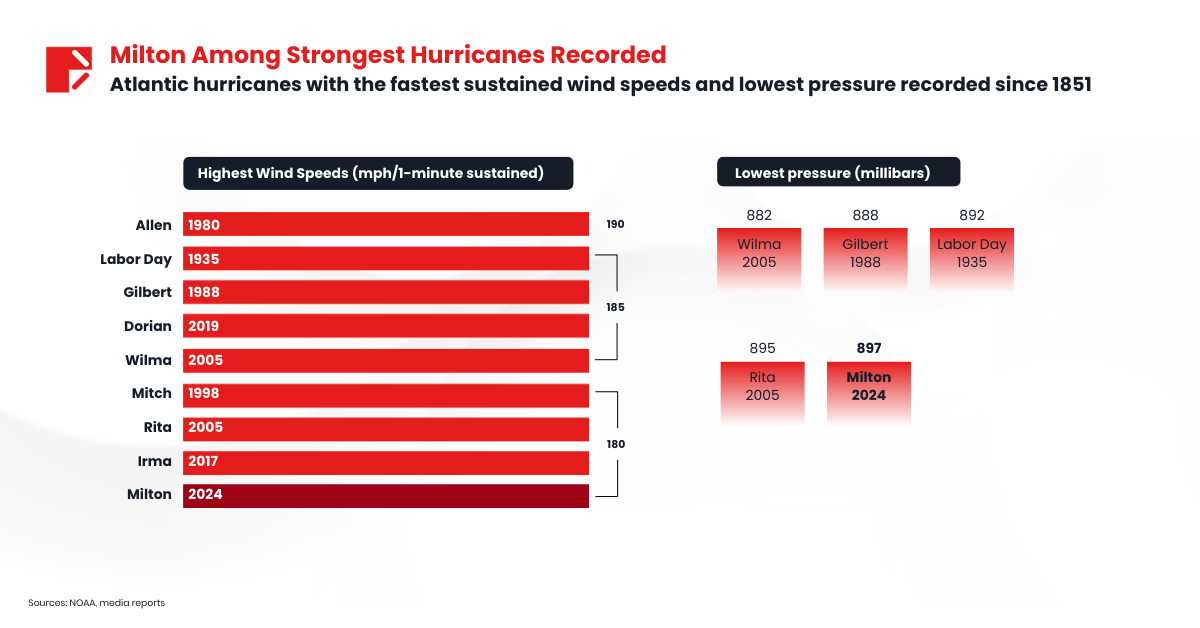

As of the afternoon of the 9th of October, Hurricane Milton has intensified into a major Category 4 storm, with the National Hurricane Center reporting sustained winds of 130 mph. The hurricane is expected to make landfall near Tampa Bay, threatening substantial storm surge and unprecedented damage. This severe weather event could potentially surpass the damage caused by Hurricane Katrina, with initial projections estimating property damage could reach USD 175 billion.

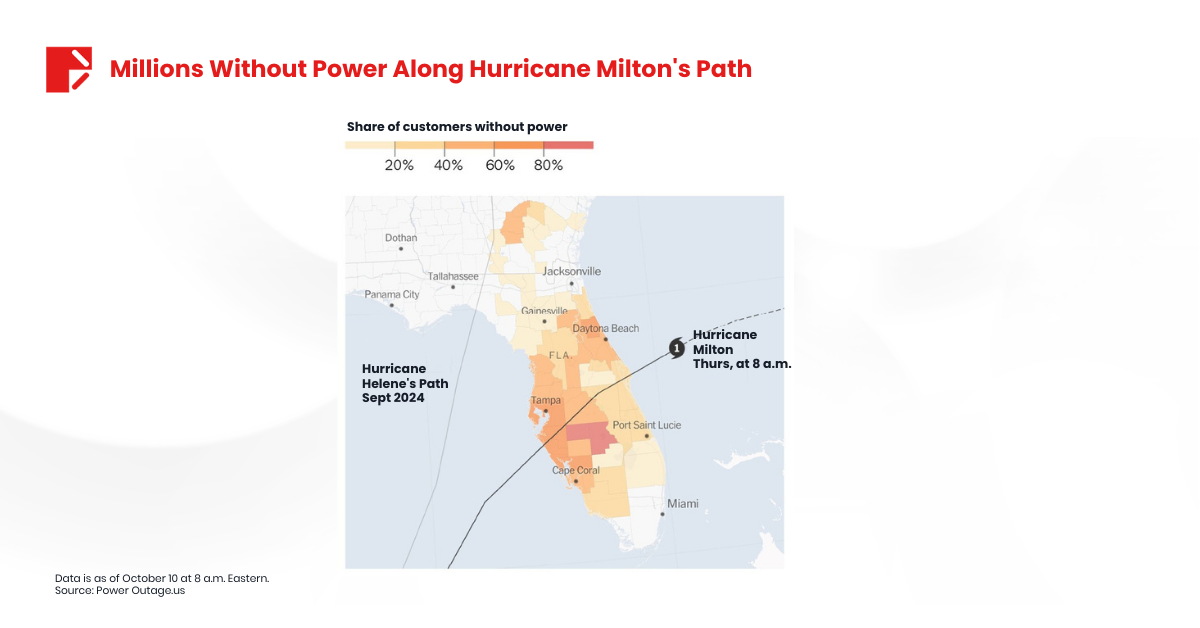

Although the storm’s path took it south of the highly vulnerable Tampa Bay region, it has already spawned deadly tornadoes and brought powerful winds across a wide swath of the state. Over 1.5 million people remained without power last Saturday, and the hurricane has been blamed for at least 17 deaths. Additionally, officials are concerned that the heavy rainfall brought by Milton will cause flooding along several rivers in the days ahead, exacerbating the challenges faced by emergency response teams and heightening the risk to affected communities.

Airline Industry: Navigating Through the Storm

The airline industry is currently facing a storm of challenges, with Hurricane Milton’s imminent landfall in Florida causing significant operational disruptions. Steve Trent, Managing Director at Citi, offers a detailed analysis of the situation’s impact on airline stocks during these turbulent times. According to Trent, for every 1% decline in available seat mile growth, airlines typically see a corresponding 2% drop in pre-tax earnings. This metric highlights the sensitive balance airlines maintain between operational capacity and financial stability.

He mentioned that low-cost airlines are highly vulnerable to disruptions caused by severe weather events like Hurricane Milton. These carriers have substantial operations in Florida, the expected point of impact, placing them at increased risk compared to their larger counterparts. Trent notes that in the post-pandemic landscape, low-cost carriers such as Spirit Airlines (SAVE) have struggled to maintain market share against major network airlines like Delta (DAL) and United (UAL). This challenge is compounded by their lack of diverse revenue streams, which in more robust operations help mitigate losses from decreased seat miles.

The financial health of low-cost airlines is further strained as they attempt to navigate the dual headwinds of natural disasters and competitive pressures. The situation underscores the broader vulnerabilities within the airline industry, particularly for budget carriers that lack the financial cushion and operational flexibility of larger airlines. As Hurricane Milton approaches, the industry braces for the impact, highlighting the ongoing struggle for stability in an increasingly unpredictable environment.

Insurance Sector: Bracing for Record Claims

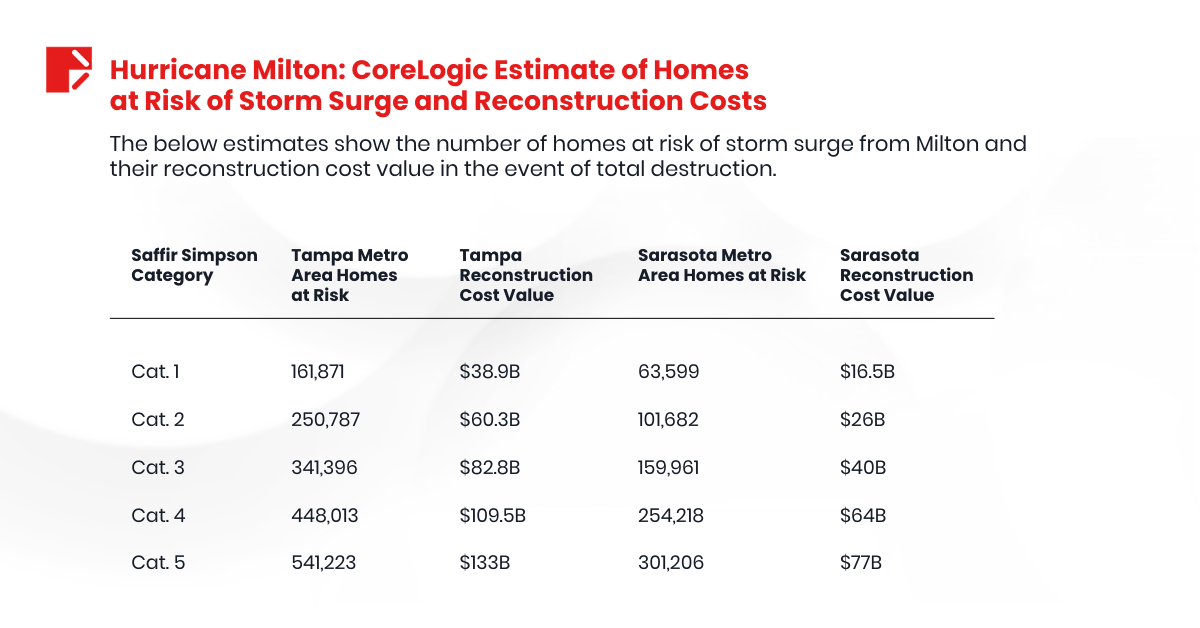

On the other hand, the insurance industry braces for potentially unprecedented claims. Analysts predict that insured losses could surpass all previous US natural disasters due to the storm’s path through densely populated Florida. However, significant gaps in flood insurance coverage expose many homeowners to financial risk, as standard policies typically exclude flood damage.

Only about 23% of residents in Sarasota County, directly hit by Milton, have flood insurance despite high risks. Nationally, the coverage is even less common, with only 6% of homes insured against floods, though nearly every county in the US has experienced flooding since 1996. This disparity highlights a critical nationwide issue of under-preparedness against flood damage.

In Florida, the insurance market faces additional challenges with soaring premiums and a high rate of insurer insolvencies. Prices have increased dramatically, with some areas seeing premium hikes of at least 80% since 2020, driven by high litigation costs and rising construction expenses. This has forced many insurers out of the state, leaving homeowners with fewer and more expensive options.

The state’s response, through programs like Florida’s Citizens Property Insurance, aims to provide coverage where private insurers have retreated. However, this stopgap is under pressure from the increasing frequency and severity of storms, emphasizing the need for reform in managing and insuring flood risks. Without significant changes, the financial vulnerability of homeowners will likely increase, emphasizing the urgent need for comprehensive insurance reform.

Real Estate Industry: Facing a Market Downturn

Hurricane Milton, together with Hurricane Helene, has brought about unprecedented damage across Florida, marking it as one of the most financially devastating events in US history. Early estimates by analysts at AccuWeather project the damage and economic losses from Milton to be between USD 160 billion and USD 180 billion. This staggering figure arises not only from the widespread flooding and continued water rescues but also from severe storm effects such as an EF3 tornado that demolished over 100 homes in the upscale Avenir development in Palm Beach Gardens, significantly far from where Milton made landfall at Siesta Key.

This loss is massive compared to historical data. For perspective, the inflation-adjusted cost of Hurricane Katrina, previously the most expensive hurricane in US history, was about USD 320 billion. The combined impact of Helene and Milton is estimated to approach nearly half a trillion dollars, equating to almost 2% of the United States’ USD 26 trillion GDP.

Joel Myers, founder and executive president of AccuWeather, highlighted the severe implications of these losses, particularly noting that they could erase all expected economic growth in the fourth quarter of this year and the first quarter of 2025.

The real estate market, especially in hurricane-prone areas, faces a dual challenge: direct damage to properties and a potential long-term decline in property values. Investors and homeowners alike may rethink the viability of investing in such high-risk areas, which could depress market values further and slow the recovery process. The scale of these events underscores the need for more robust infrastructure and insurance strategies to mitigate future risks, as the financial stability of entire regions and the broader national economy hangs in balance.

Broader Economic Implications

The economic fallout from Hurricanes Milton and Helene extends far beyond immediate physical damage. These storms have caused significant disruptions in supply chains, substantial agricultural losses, and widespread infrastructure damage, rippling through the economy and affecting national GDP and global markets.

The Congressional Budget Office (CBO) estimates that the expected annual economic losses from storm surges, heavy precipitation, and high winds from hurricanes or tropical storms total USD 54 billion. This figure represents about 0.3 percent of the nation’s current gross domestic product (GDP), underscoring the substantial economic burden imposed by these natural disasters.

Strengthening Financial Resilience in the Face of Natural Disasters

Hurricanes Milton and Helene have vividly illustrated the extensive and varied economic impacts of major natural disasters. These events highlight the urgent need for enhanced disaster preparedness and economic resilience strategies. As we move forward, the insights gained should guide policy improvements and innovations in disaster management, ensuring communities are better equipped to handle and recover from future calamities efficiently.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.