Investment is indispensable in the financial sector and deemed as an important element for economic growth. It can help individuals to build wealth and support businesses to achieve long-term financial goals. Therefore, financial regulators play a big role in maintaining trust and integrity in the financial system, especially in today’s constantly changing market. As a pre-eminent financial services group, Doo Prime’s holding company, Doo Group, always promotes ethical business practices across all of our operations. And that is why Doo Group has acquired full-fledged financial regulatory licenses across various countries and regions.

In this article, we would like to share about one of Doo Group’s licenses granted by the prestigious world-class financial regulator, the Australian Financial Services (AFS) License, and how to undergo the license verification process of a company.

About The ASIC

Granted by the Australian Securities & Investments Commission (ASIC), the AFS License is a license that allows company to conduct a financial services business. ASIC is an independent Australian Government body that regulates the county’s financial markets and services to assure a fair and transparent financial environment.

In compliance with international standards and norms, the regulator is set up and mandated under the Australian Securities and Investments Commission Act 2001 (ASIC Act).

Upholding the core values of accountability, professionalism and teamwork, ASIC adheres rigorously to the global supervisory framework, in order to protect the consumers’ rights and benefits.

Just like here in Doo Group, our vision is strongly driven by our client-centric culture. This is what made the Group apply for a financial services license from the ASIC. Under the administration of the regulator, Doo Financial Australia Limited under Doo Group is authorized to conduct relevant financial services and business in Australia.

In order to let our clients learn more about our license details, we have prepared guidelines on the license verification procedures.

How To Identify And Verify Financial Firms Regulated By The ASIC:

You may perform the verification through a search on ASIC Services Register. Let’s use Doo Financial Australia Limited as an example here.

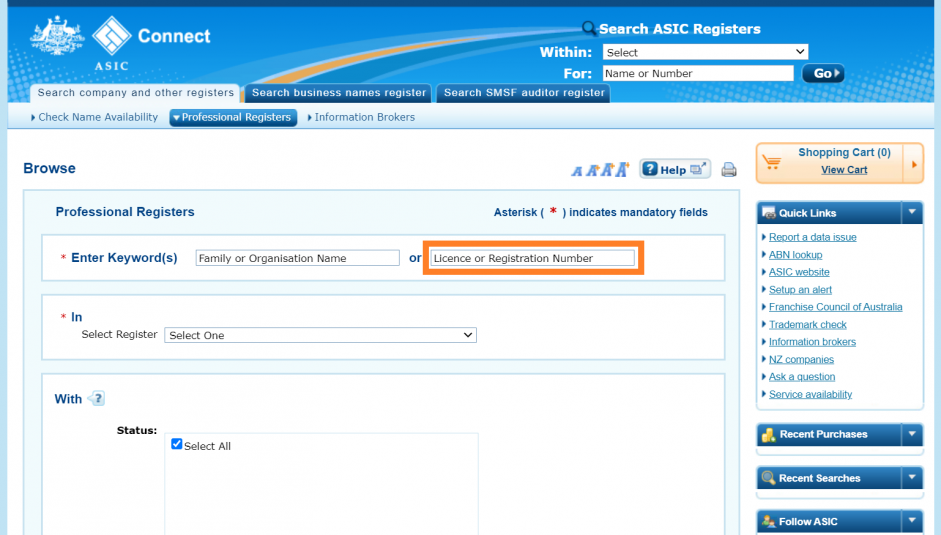

Step 1: Please visit the ASIC Connect’s official website at https://connectonline.asic.gov.au/

Step 2: Please click on “Professional Registers”.

Step 3: You will be redirected to the “Professional Registers” page. Please type “222650” into “License or Registration Number” field.

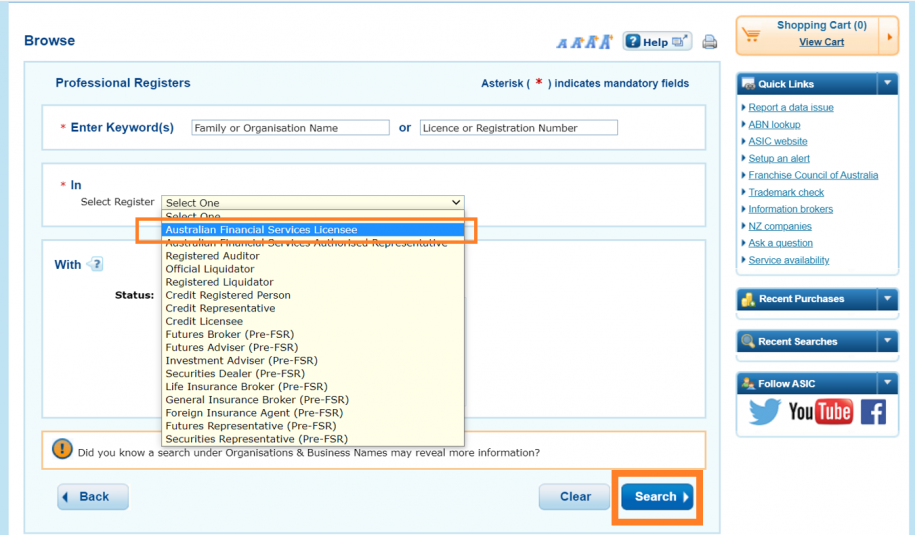

Step 4: Please select “Australian Financial Services Licensee” in the “Select Register” field, then click on “Search” button at the bottom.

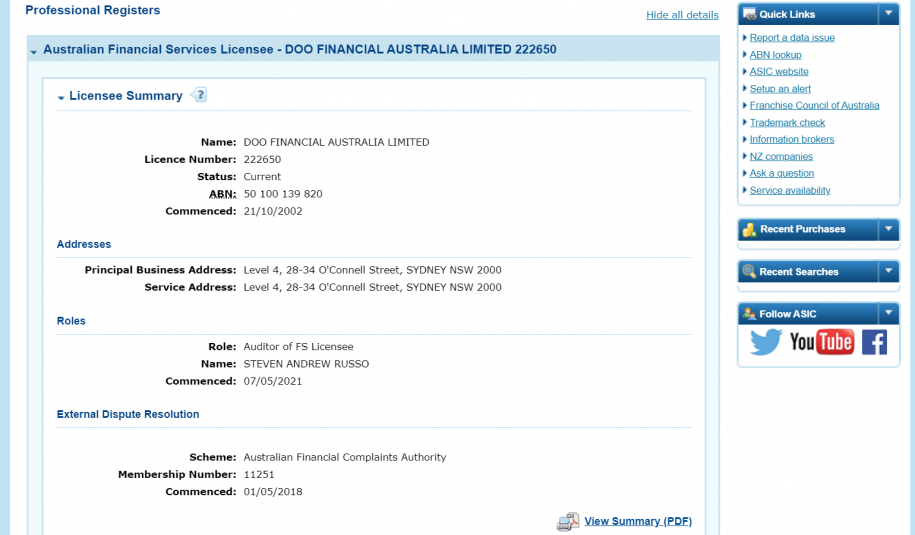

Step 5: The details of the company will be shown, including addresses, roles and external dispute resolution, as below.

Under the regulation of the ASIC, Doo Group strictly adheres to the relevant regulatory requirements, ensuring a safe and sound trading environment.

A properly certified financial services company will have these legal details shown and detailed on the ASIC Register when one performs the check.

Doo Group will continue to provide safe, reliable and professional services to our valued clients under the supervision of the top financial regulator.

About Doo Group

Doo Prime’s holding company Doo Group, was established in 2014, currently headquartered in Singapore. After years of development, Doo Group has become a multi-faceted financial services group with financial technology as its core. With multiple sub-brands such as Doo Clearing, Doo Financial, Doo Prime, FinPoints and more, Doo Group is committed to provide trading and asset management services for over 20,000 financial products such as Securities, Futures, Forex, CFDs and Funds to global individual and institutional clients.

Currently, the entities within Doo Group, according to their location and products, are regulated by many of the top global financial regulators, including, but not limited to, the United States Securities and Exchange Commission (US SEC) and Financial Industry Regulatory Authority (US FINRA), United Kingdom Financial Conduct Authority (UK FCA), the Australian Securities & Investments Commission (AU ASIC), the Hong Kong Insurance Authority (HK IA), the Hong Kong Customs and Excise Department (HK C&ED), the Hong Kong Companies Registry (HK CR), the Seychelles Financial Services Authority (SC FSA), Mauritius Financial Services Commission (MU FSC), and the Vanuatu Financial Services Commission (VU FSC). Doo Group has entities operating in various global locations, including Dallas, London, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur as well as other regions.

For enquiries and further information, please contact us:

Hong Kong: +852 6701 2091

Singapore: +65 6011 1736

Email: marketing@doogroup.com

Forward-looking Statement

“Forward-looking” Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Group will be generally assumed as forward-looking statements.

Doo Group has provided these forward-looking statements based on all current information available to Doo Group and Doo Group’s current expectations, assumptions, estimates, and projections. While Doo Group believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Group’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Group does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Group is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.