“Accelerated computing and generative AI have hit the tipping point,” said Nvidia founder Jensen Huang, anticipating a surge in AI demand in 2024.

Last week, OpenAI unveiled the groundbreaking text-to-video model, Sora, taking the tech industry by storm. Generative AI models are emerging rapidly, reflecting the swift pace of technological evolution. In fact, the year 2024 is being hailed as the ‘Year of Generative AI Proliferation,’ and amid numerous specialized domains, what trends should investors focus on?

This article will dissect the recent key developments in AI and their impact on the stock market. We will also analyze AI trends that are worth monitoring in 2024, helping you to strategically position yourself within the AI sector.

Sora Ignites The Tech Scene, AI’s Rapid Evolution

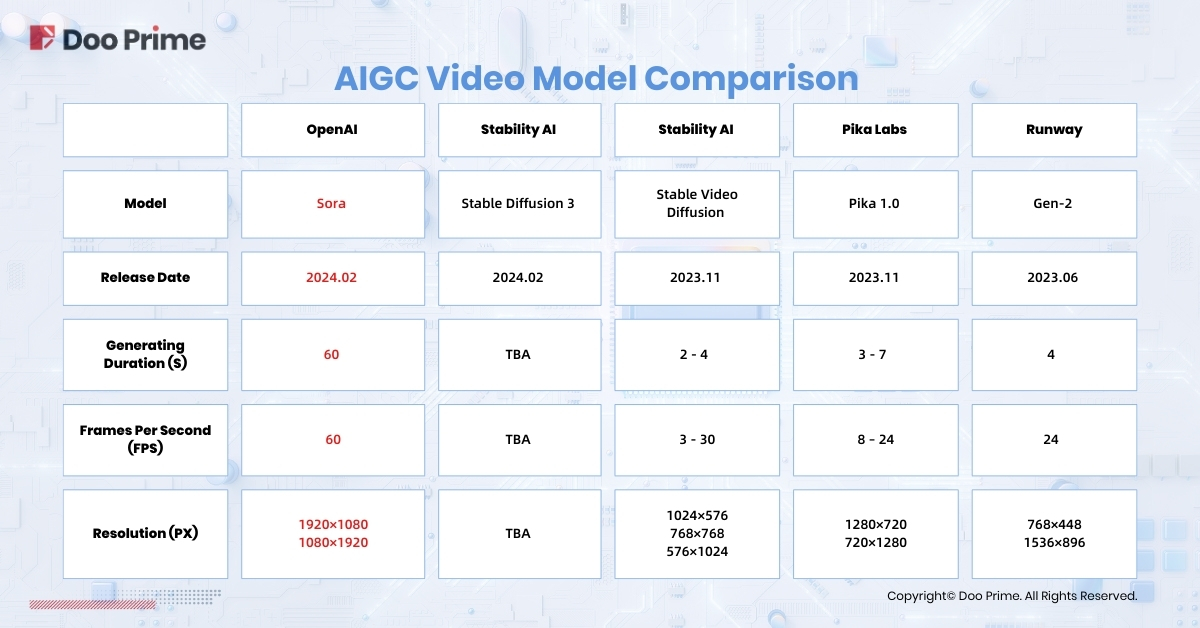

On February 16th, OpenAI unexpectedly released the impressive text-to-video model, Sora. Capable of generating a 60-second video based on textual instructions or static images, Sora includes intricate scenes, lively character expressions, and sophisticated camera movements. Furthermore, it can seamlessly extend existing videos or fill in missing frames.

Sora’s technical achievements surpassed all previous text-to-video models, leading by a large margin in video length, fidelity, resolution, and text comprehension, demonstrating the potential to simulate the physical world. The introduction of Sora marks a significant milestone in AI technology, poised to revolutionize the multimodal industry and spark global discussions.

As a result, the popularity of Sora has overshadowed other emerging AI models.

Within the first two hours of OpenAI’s release of Sora, Google took the lead by introducing the next-generation multimodal model, Gemini Pro 1.5. It has made groundbreaking strides in cross-modal understanding, capable of processing complex contexts of up to 1 million tokens in a single stable operation. This is equivalent to handling one hour of video, eleven hours of audio, over 30,000 lines of code, or 700,000 words.

Moreover, on February 15th, Meta also unveiled the Video Joint Embedding Predictive Architecture (V-JEPA), a method that teaches machines to understand and simulate the physical world by watching videos.

Technology is ever-changing. Just days after the debut of Sora, Stability AI introduced its next-generation flagship text-to-image generation AI model, Stable Diffusion 3.0, on the 23rd. This model, operating on an architecture like Sora, boasts substantial improvements in image quality, multi-object handling, and spelling capabilities.

Not only that, following Google’s launch of Gemini 1.5 Pro, Microsoft swiftly introduced the large-scale LongRoPE model, extending the context to 2 million tokens.

U.S. Stocks Stumble, A-Shares and H-Shares Soar in the Year of the Dragon

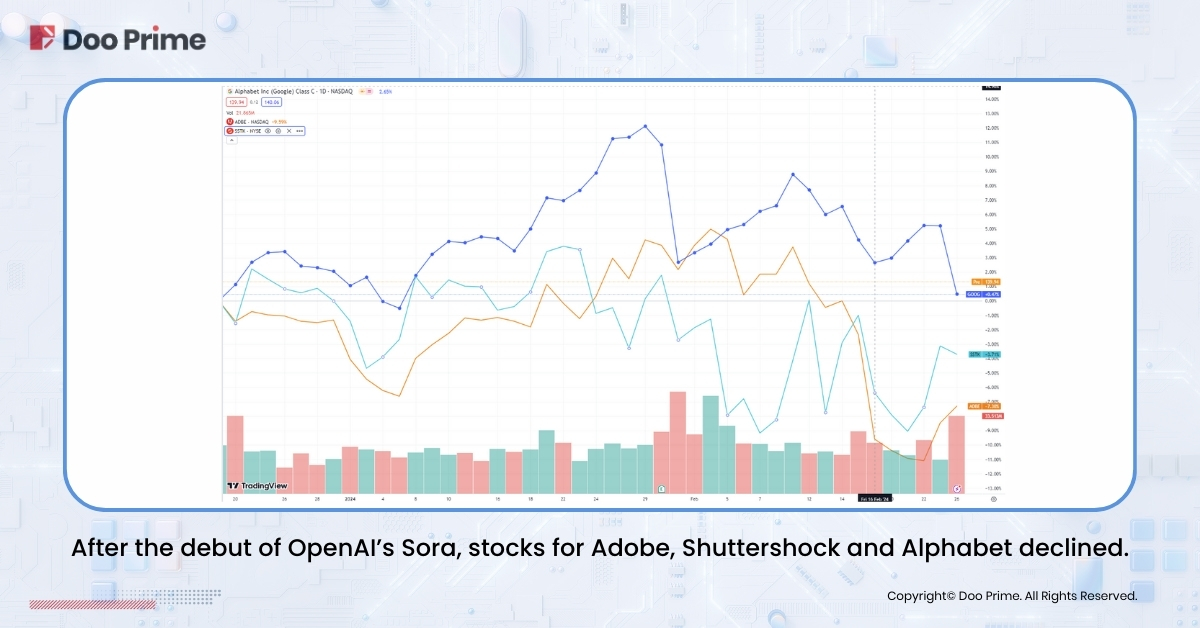

The emergence of OpenAI’s Sora has not only sparked heated discussions but also triggered market fluctuations.

On the 16th of February, shares of the American computer software company Adobe experienced a sharp decline of 7.41%, marking a new low since November 1st of the previous year. This downturn resulted in a substantial market value reduction of nearly USD 19.8 billion within a single trading day.

On the same day, the U.S.-based provider of stock photos, images, music, and editing tools, Shutterstock, witnessed a 5.44% dip in its stock, resulting in a market value erosion of USD 93.6 million.

Alphabet, the parent company of Google, also witnessed a 1.58% decline on that day, resulting in a market value loss of USD 27.9 billion within a single day.

However, the A-share market painted a different picture. On February 19th, the first trading day of the Year of the Dragon, the Sora concept sparked a notable rally. BizConf Telecom, Hangzhou Arcvideo, Wondershare Technology, Yeahmobi, and Guangdong Insight Group all hit the 20% upper limit; Business-intelligence of Oriental Nations Corporation (BONC), Sumavision Technologies rose over 14%; Hylink, New Guomai Digital Culture, and others hit the 10% upper limit.

On February 20th, the Sora concept continued its frenzy surge, with at least 66 stocks in both A-shares and Hong Kong stocks experiencing significant gains. Additionally, over 20 brokerage firms released research reports on Sora.

AI’s Rapid Evolution, 3 Major Trends To Keep Watch In 2024

In 2023, fueled by the ChatGPT phenomenon, several deep learning models trained on massive textual datasets emerged, marking it as the ‘Year of Large Language Models.’ As we step into 2024, the AI landscape is shifting its focus towards the practical application of these expansive language models, anticipating it to be the ‘Year of Generative AI Proliferation.’ The debut of the text-to-video model, Sora, stands as a significant milestone. Amid the flourishing landscape of AI subfields, three major trends are poised to stand out this year.

AI Chips

As large models continue to emerge, there is an increasing demand for essential components such as AI chips. Currently, Nvidia stands as the dominant powerhouse in the AI chip domain. However, emerging AI startup Groq has launched its in-house LPU chip, promising faster inference and generation speeds, along with lower prices and power consumption. This has presented a formidable challenge to Nvidia’s dominant position.

Simultaneously, tech giants are actively investing in AI chip development. Currently, major clients of NVIDIA, including Google, Microsoft, Amazon, Meta, and other industry giants, have launched their proprietary chips. These include Google’s TPU, Microsoft’s Azure Maia 100 and Cobalt 100, Amazon’s training chip Trainium and inference chip Inferentia, and Meta’s newly operational Artemis, marking a significant trend in the industry.

Furthermore, AI leader OpenAI is raising funds ranging from USD 5 trillion to USD 7 trillion. The objective is to initiate a project aimed at enhancing global chip manufacturing capabilities.

This indicates that the landscape of AI chips may undergo a significant transformation in 2024. Amidst fierce competition, the evolution of AI chip development is set to continue, promising us with more exciting advancements.

Robots

In 2024, robots are emerging as the new frontier for technology giants betting on AI applications.

The startup Figure AI Inc., focused on developing humanoid robots, is actively seeking a new funding round of up to $500 million. Microsoft and OpenAI are leading the investment, and notable participants include NVIDIA, Amazon, Intel, LG, and Samsung. ARK Investment Management, led by Cathie Wood, is also reported to be part of the financing. In January of this year, Figure AI introduced its robot Figure 01 to ‘intern’ at a BMW factory, taking over certain high-risk tasks traditionally performed by humans. The company envisions expanding its applications in the future.

OpenAI is actively venturing into humanoid robots, with investments not only in Figure AI but also in a Norwegian humanoid robot company, 1X Technologies.

NVIDIA is keeping pace with the introduction of the AI chatbot “Chat with RTX”. Diverging from ChatGPT, it operates locally, aiding in the retrieval, analysis, and provision of context-aware answers for files stored on the computer.

Tesla remains committed to the ongoing development of the humanoid robot Optimus. Elon Musk has previously emphasized that Optimus will constitute a significant portion of “Tesla’s long-term value”, highlighting the substantial growth potential within the AI robotics sector.

AI Smartphones

Moreover, the consensus that 2024 is emerging as the “Year of AI Phones” appears to be gaining widespread acceptance. Virtually every major global smartphone manufacturer is eagerly integrating AI features into their new product campaigns. In recent years, smartphone development has encountered a bottleneck, characterized by significant hardware homogenization and a scarcity of new breakthroughs and use cases in software. The incorporation of large AI models is poised to pave the way for innovation, delivering fresh user experiences for consumers and highlighting product differentiation.

Currently, Samsung leads the way by incorporating AI search functionalities, AI translation features, and AI image generation technology into the S24 series of smartphones.

The Vivo S18 series boasts the “BlueLM large model”, providing support for tasks ranging from file retrieval, poetry and lyric composition, creative image exploration, content summarization, problem-solving, to material organization.

In Honor MagicOS 8.0, the “MagicLM” includes features like intelligent photo composition, semantic search in the gallery, and the Magic Portal function.

AI Unlocks Limitless Opportunities But Harbors Unknown Risks

In 2024, AI will continue to be the market focal point, bringing about significant transformations and development opportunities across diverse industries, poised to persistently reshape human cognition. In the rapidly evolving tech landscape, while AI presents limitless opportunities, it also harbors unforeseen risks. Despite being one of the most trending investment areas, investors should carefully assess risks, including the technical maturity of AI models, business models, and policy environments. Investors must remain pragmatic, enjoying the dividends of the trend while implementing effective risk management strategies.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.