A strong USD with rising Treasury yields is never good news for the global economy. The USD has been on a tear lately, reaching multi-year highs against major and emerging market currencies. US real yields are at their highest level since 2007, which is causing some investors to worry about a repeat of the 2008 financial crisis.

These are warning signs that we should not ignore, as they reflect not just the current state of the US economy, but also the potential risks to the global economy.

In this article, we will delve into the reasons behind the strong USD, analyze the impact of rising Treasury yields, and explore the potential consequences for the global economy.

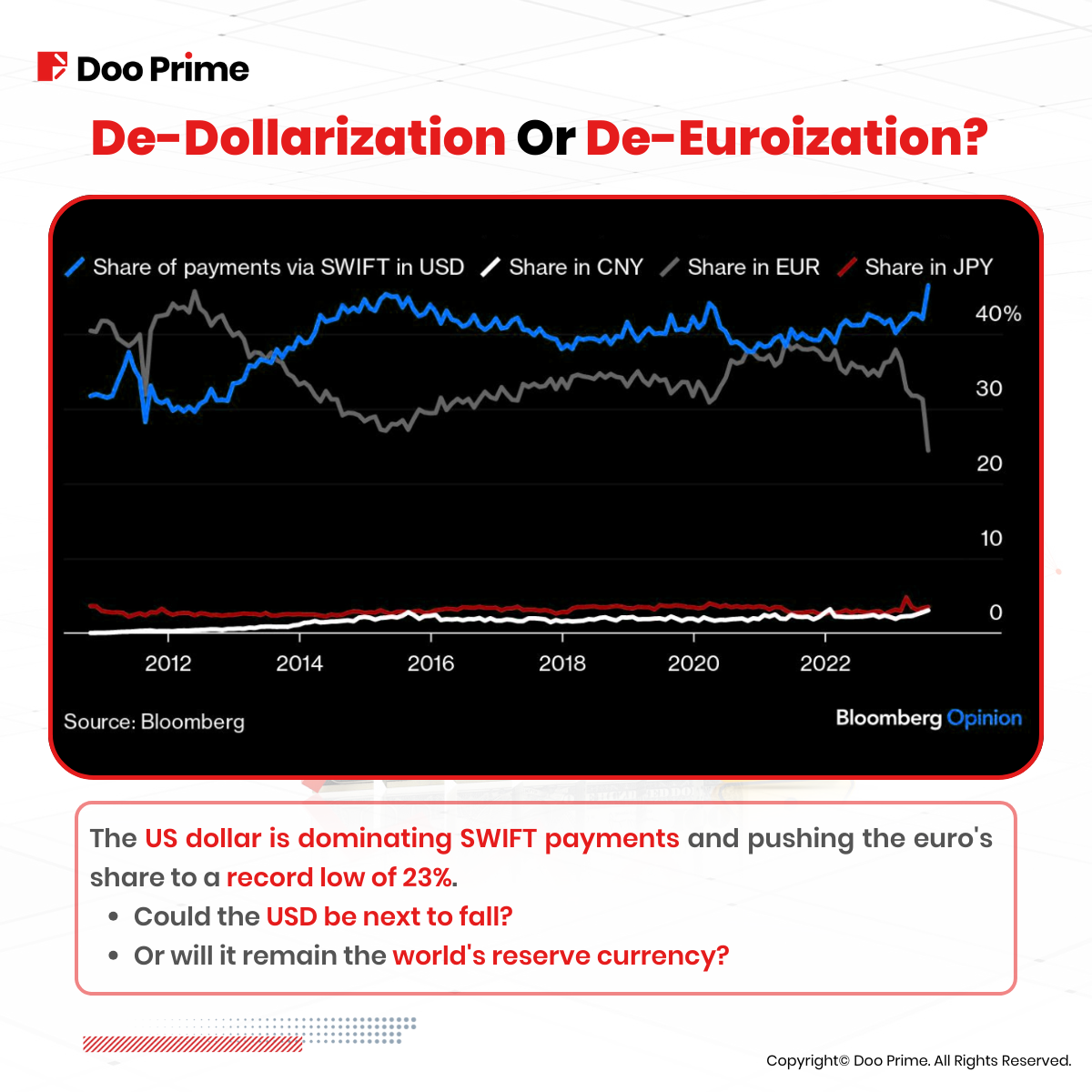

De-Dollarization or De-Euroization?

Based on SWIFT international payments data, we are witnessing a de-euroization of global payments, not a de-dollarization. The euro’s share of SWIFT global payments has dropped from 38% at the start of the year to 23% in August. This suggests that Russia’s SPFS (System for Transfer of Financial Messages) and China’s CIPS (Cross-Border Interbank Payment System) may be eating up the euro’s market share. China’s share of SWIFT payments, on the other hand, reached an all-time high of 3.47% in August.

There is also an equivalent percentage increase in the share of USD in that same period. This suggests that a big chunk of the euro’s declining market share is being taken up by the USD. This is likely due to the fact that Europe is now paying for crude oil and gas in USD rather than euros.

With Oil surging more than 25% in the past couple of months, the pressure keeps on mounting.

It is likely that the euro’s share of SWIFT payments will continue to decline in the coming months as Europe shuns China as well. China is a major trading partner of Europe, but the war in Ukraine and China’s support for Russia have strained relations between the two sides. If Europe reduces its trade with China, it will also reduce its demand for euros.

The de-euroization of global payments is a significant development. It suggests that the USD’s dominance in international payments is not as secure as it once was.

Euro could only be the beginning; USD could be next on the list as the rise of alternative payment systems such as SPFS and CIPS is likely to continue to challenge the USD’s dominance in the coming years.

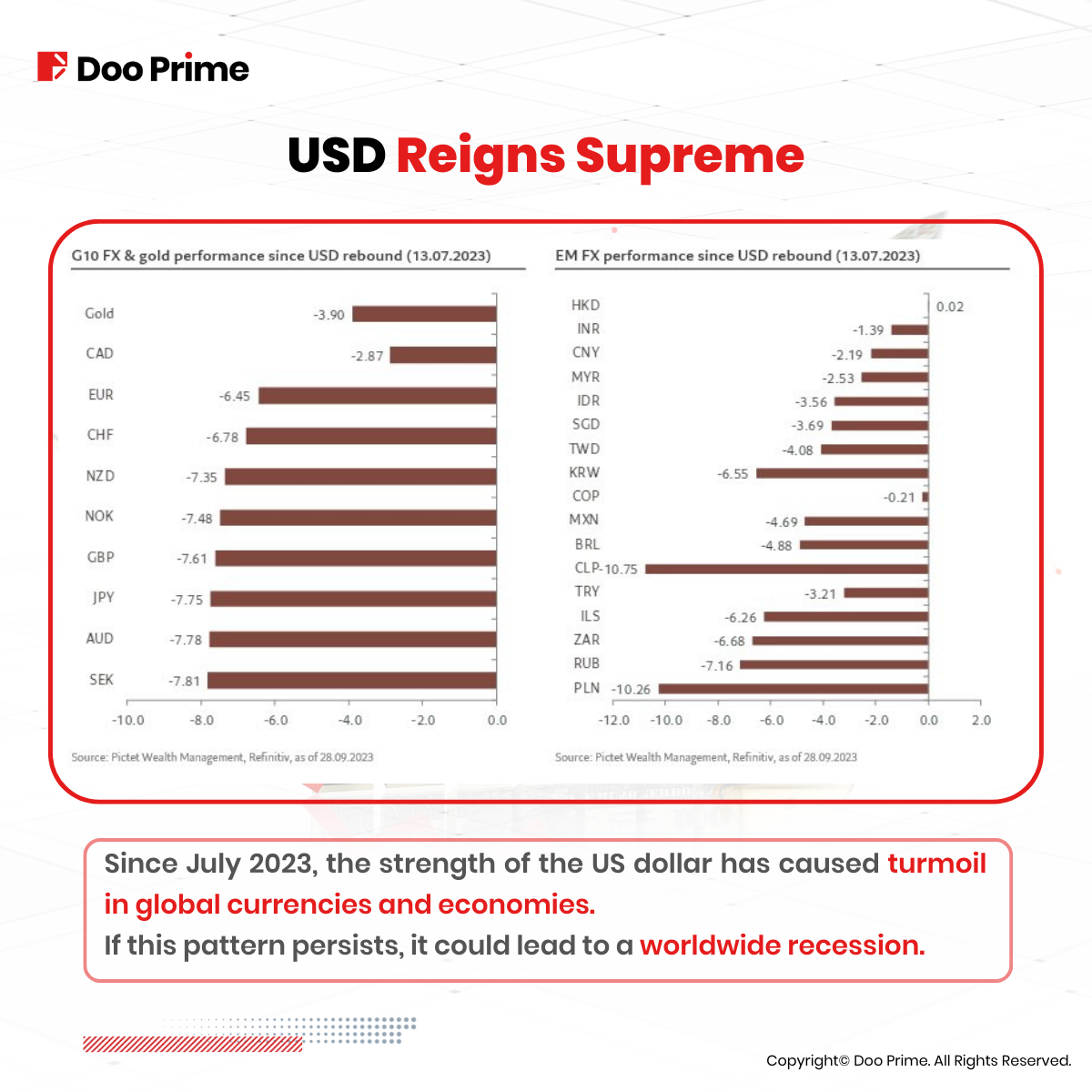

Strong USD Across The Board

Since July 2023, a broad USD strength has dominated the market. Roughly every currency in the world has been devalued in the face of aggressive raise of interest rates and treasury yields.

Domestically, a strong USD and rising Treasury yields can make it more difficult for companies to borrow funds or grow their earnings which can lead to a decline in stock prices. Internationally, a strong USD can make it more difficult for emerging market countries to repay their debts and import goods from the US, which could lead to a global financial crisis.

For the past 80 years, whenever the Fed overtightened its monetary policy by raising interest rates, the strength of the USD has pushed the market to collapse and sent the economy into a recession.

Will chairman Powell do things differently? Did the Fed learn its lesson to avoid a recession?

Many economists and investors believe that the Fed is taking too much risk by raising interest rates so aggressively, which would be much more damaging to the economy than inflation.

However, the Fed has continued to emphasize its commitment to bringing inflation down and has said it will keep interest rates high for as long as necessary until they reach the 2% target.

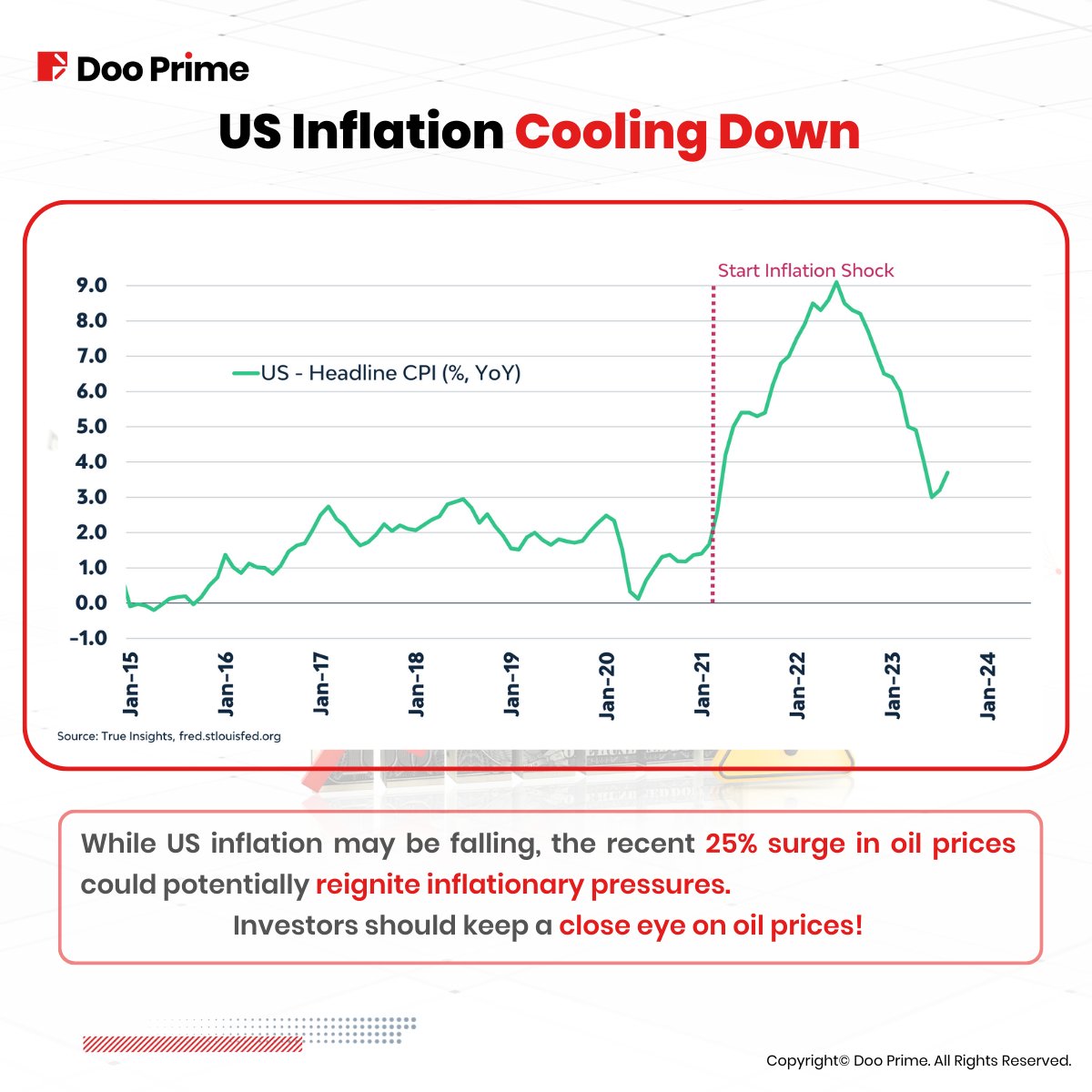

Is US Inflation Cooling Down?

Inflation in the US is indeed cooling down and disappearing faster than average. However, the Fed shouldn’t celebrate victories over inflation just yet, as elevated oil prices might trigger another upward inflation wave.

The best example of ‘premature celebrations’ was back in the mid-1970s. After US headline inflation dropped from 12% to 5% in the mid-70s, the threat of inflation seemed to have passed. The Federal Reserve lowered the interest rate from a peak of 13% in 1974 to 4.75% at the beginning of 1976. However, this proved a grave mistake, as from 1977, headline inflation increased for three consecutive years, peaking at 14.8%.

This recent sudden surge of oil prices has increased the chance of inflation spiking back above 4%.

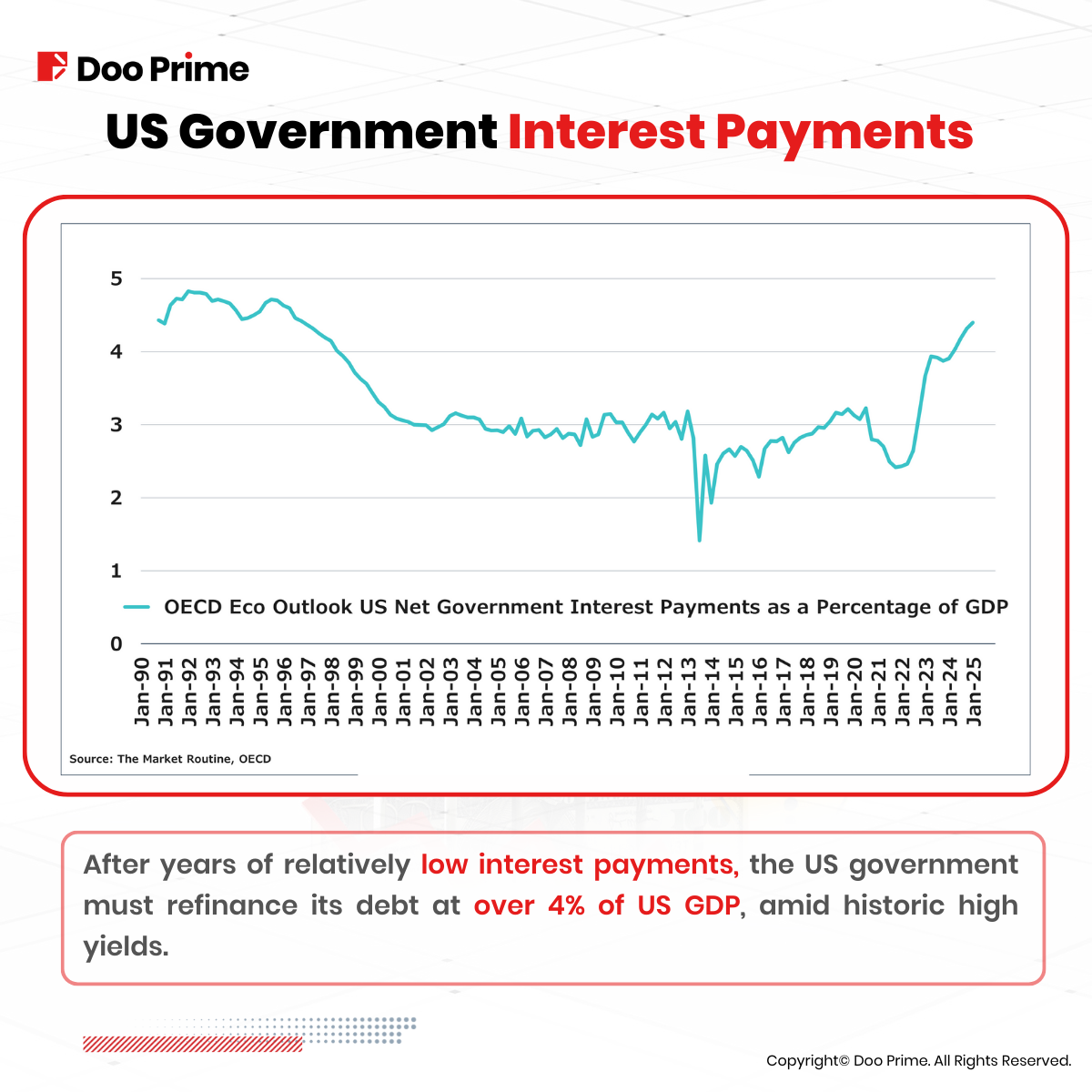

US Interest Payments Through The Roof

Interest payments on US debt are set to balloon to over USD 270 billion in 2023, based on current short-term yields. This is a staggering 90 times higher than the USD 3 billion in annual interest payments that the US would have paid if it had refinanced its debt in 2021.

Now imagine that the US has to refinance its entire debt at current yields. The total interest payments would total to a whopping USD 1.33 trillion, representing more than 5% of US GDP!

Obviously, the US will not have to refinance its entire debt all at once. But because nearly half of US debt will mature in the next three years, and Fed Chair Jerome Powell has hinted that it could take years for yields to come down, the US will be “locking in” a significant portion of those rising interest payments.

However, it is unlikely that the Fed will succeed in keeping yields at current levels for long, given the high risk of recession. This means that interest payments on the US debt are likely to increase significantly.

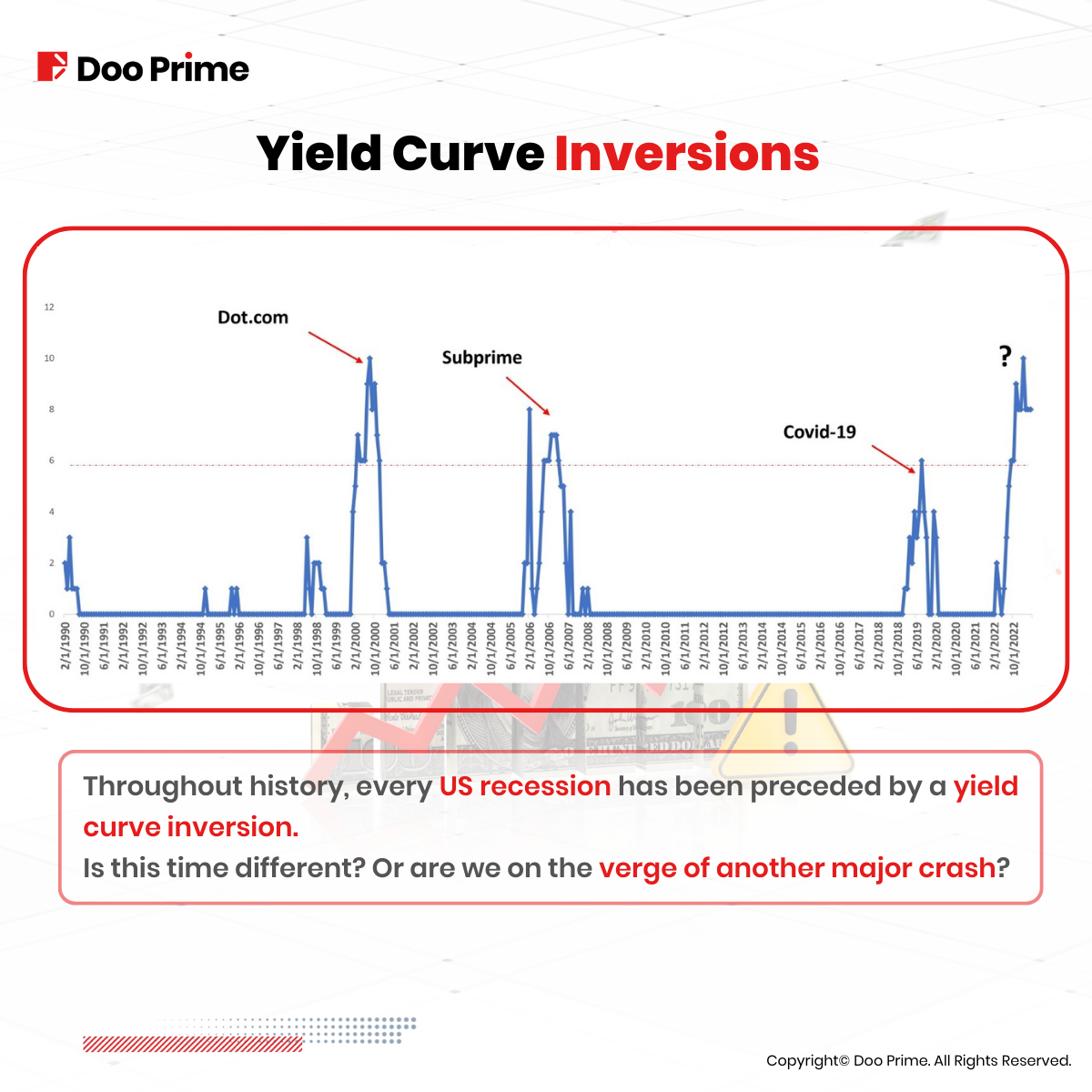

Yield Curve Inversion

Yield curve inversion is a phenomenon that occurs when the yields on short-term bonds are higher than the yields on long-term bonds. This is typically seen as a sign of an impending recession, as it indicates that investors are more pessimistic about the future of the economy.

Historically, yield curve inversions have been a reliable predictor of recessions. In fact, every recession in the US since 1955 has been preceded by a yield curve inversion.

The current inversion is the most significant since 1981. It is also the longest-lasting yield curve inversion in history.

The inversion began in March 2022, when the yield on the 2-year Treasury note exceeded the yield on the 10-year Treasury note and has persisted ever since. The spread between the 2-year and 10-year yields has widened in recent months.

The only way to avoid a recession is for the Fed to engineer a soft landing. However, with the current aggressive tightening policy, the odds of a soft landing are decreasing.

The Fed’s Dilemma

Historically, we have reached a point where significant monetary tightening begins to hurt the economy.

The Fed is once again in a tight spot. Should it raise interest rates further to bring inflation down to its 2% target, even if these risks cause a recession? Or should it allow inflation to remain high in order to protect the stock market?

Given that central banks aim for a soft landing, the Fed should change its tone and avoid mentioning “higher rates for longer” in its upcoming FOMC meetings. A pause in rate hikes would likely give stocks some breathing room to go higher and the USD/yields to fall in the short term.

However, if oil prices remain resiliently higher, then the Fed may be forced to abandon its hopes for a soft landing and focus on fighting inflation, even if this means causing a recession.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment, and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to learn more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.