Today’s News

Major stock indexes saw gains at the commencement of the shortened holiday trading week, indicating a potentially positive conclusion to a year that had its challenges in 2022.

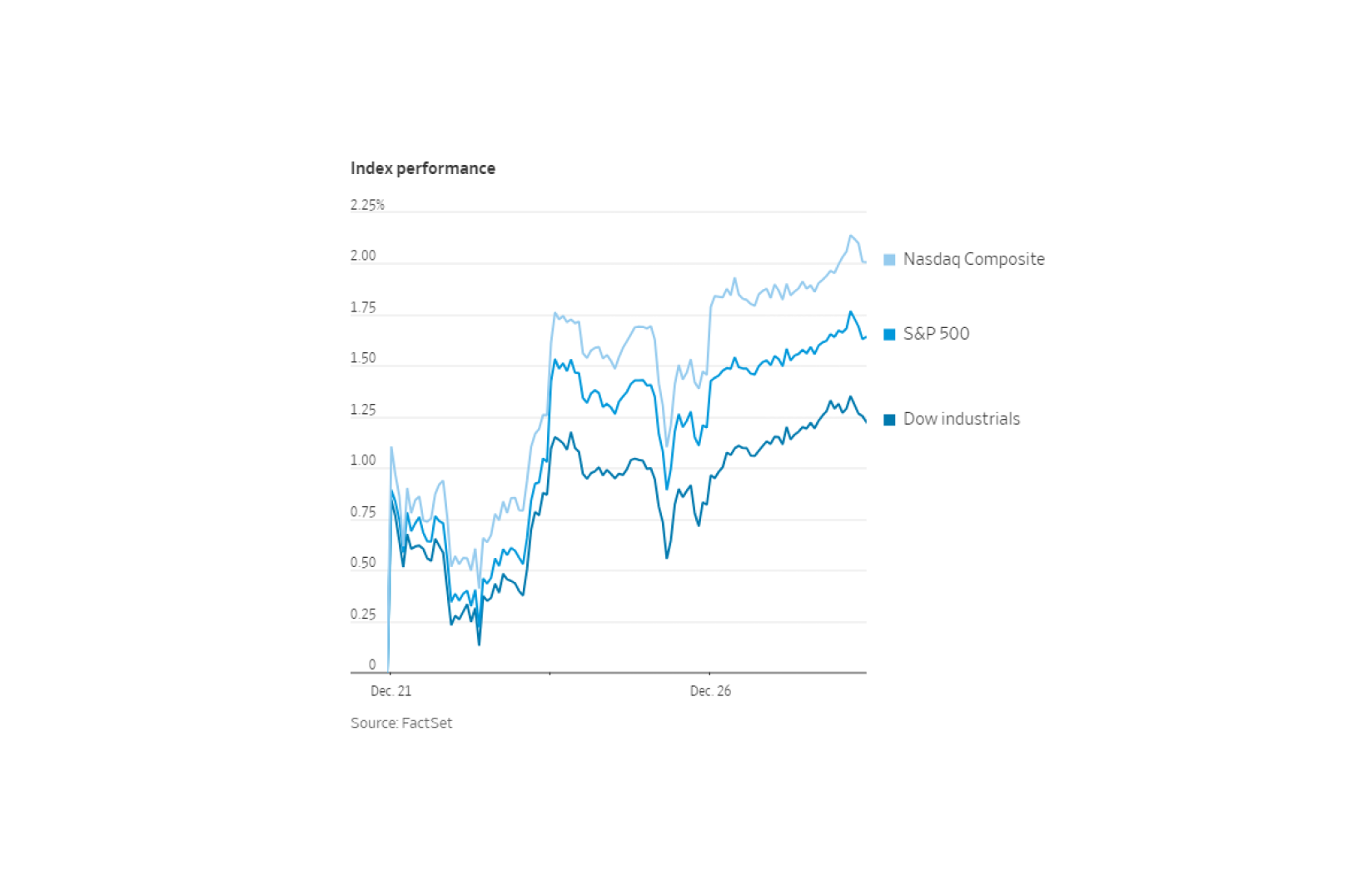

The S&P 500 rose by 0.4% on Tuesday, approaching a record close, with the Nasdaq Composite climbing 0.5%, and the Dow Jones Industrial Average ascending by 0.4%, or approximately 159 points. The Russell 2000, known for its strong performance in December, surged by 1.2%.

This rise could signify the advent of what’s known as a “Santa Claus rally,” denoting the historical tendency of U.S. stocks to increase during the final five trading sessions of a year and the initial two of the following year.

Investor sentiment remains positive as we approach 2024. The Federal Reserve’s interest rate hikes have effectively managed inflation without causing a recession, leading many fund managers to anticipate potential rate cuts by the central bank in the coming year. Recent data showing continued consumer spending during the holiday season has also contributed to this optimism.

According to Louis Navellier, chief investment officer at Navellier & Associates, December is poised to end on an upbeat note, remarking, “There’s a lot to look up to.”

Image Source: FactSet

The surge in front-month futures for benchmark Brent crude oil, rising by 2.5% to USD 81.07 a barrel, was influenced by shipping disruptions in various regions including the Indian Ocean, Red Sea, and Arabian Sea. This surge in oil prices propelled the energy sector, contributing to the broad-based gains in the S&P 500, with Marathon Oil shares rising by 2.1%.

However, the escalation in energy prices had adverse effects on travel stocks. Norwegian Cruise Line Holdings declined by 2.9%, Carnival fell by 1.7%, and American Airlines Group and United Airlines Holdings saw minor decreases as well.

In other market movements, Bristol-Myers Squibb’s shares dipped by 1.6% following a USD 4.1 billion deal to acquire RayzeBio, betting on the resurgence of cancer drug technology. Conversely, AstraZeneca’s New York-listed ADRs edged up by 0.3% after its USD 1.2 billion agreement to purchase Gracell Biotechnologies, aimed at bolstering its cell-therapies business.

Intel experienced a notable surge of 5.2% in its shares, marking its highest close since March 2022, while Advanced Micro Devices saw a 2.7% increase. This led to a 1.8% uptick in the PHLX Semiconductor Index.

Bond markets saw slight movement, with the 10-year Treasury note yield decreasing marginally to 3.885%, while the 2-year Treasury yield slightly increased to 4.339%.

Overseas, the Shanghai Composite Index experienced a 0.7% decline, reaching a 52-week low, as the recent selloff in Chinese videogame stocks seemed to ease. European and Hong Kong markets were closed during this period.

Other News

BNP Paribas Probed In French Money Laundering

French prosecutors investigate alleged “aggravated money laundering” involving significant transfers by TCR International Limited, associated with BNP Paribas’ custodian unit, following a notice from France’s anti-money laundering unit.

China’s Yuan Surges Amid Global Trade Shifts

China’s yuan usage surges in global trade, doubling monthly since mid-2020, nearing a quarter of China’s total goods trade value. This rise, notably in trade with Russia, offers potential insulation against Western sanctions.

Nasdaq Leads IPOs, Defying NYSE For Fifth Year

Nasdaq continues its IPO dominance over the New York Stock Exchange (NYSE) for the fifth consecutive year, raising USD 13.6 billion compared to NYSE’s USD 10.4 billion in 2023. Nasdaq’s win streak reflects a transformation in Wall Street’s rivalry.