Today’s News

Stock markets remained steady on Tuesday while the dollar and bonds showed signs of caution as global investors awaited the U.S. presidential election, with polls indicating an intensely close race.

MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, while Japan’s Nikkei index rose by 1.3% in morning trade as it reopened after a holiday. S&P 500 futures edged up 0.1%.

Image Source: Al Jazeera

In currency markets, the dollar saw modest overnight declines, with traders making last-minute position adjustments. It held at 152.35 yen and USD 1.0875 per euro. “They’ve priced what they think is price-able and that’s that,” said Westpac strategist Imre Speizer, who added that a Trump victory would likely boost the dollar, whereas a Harris win could nudge it lower.

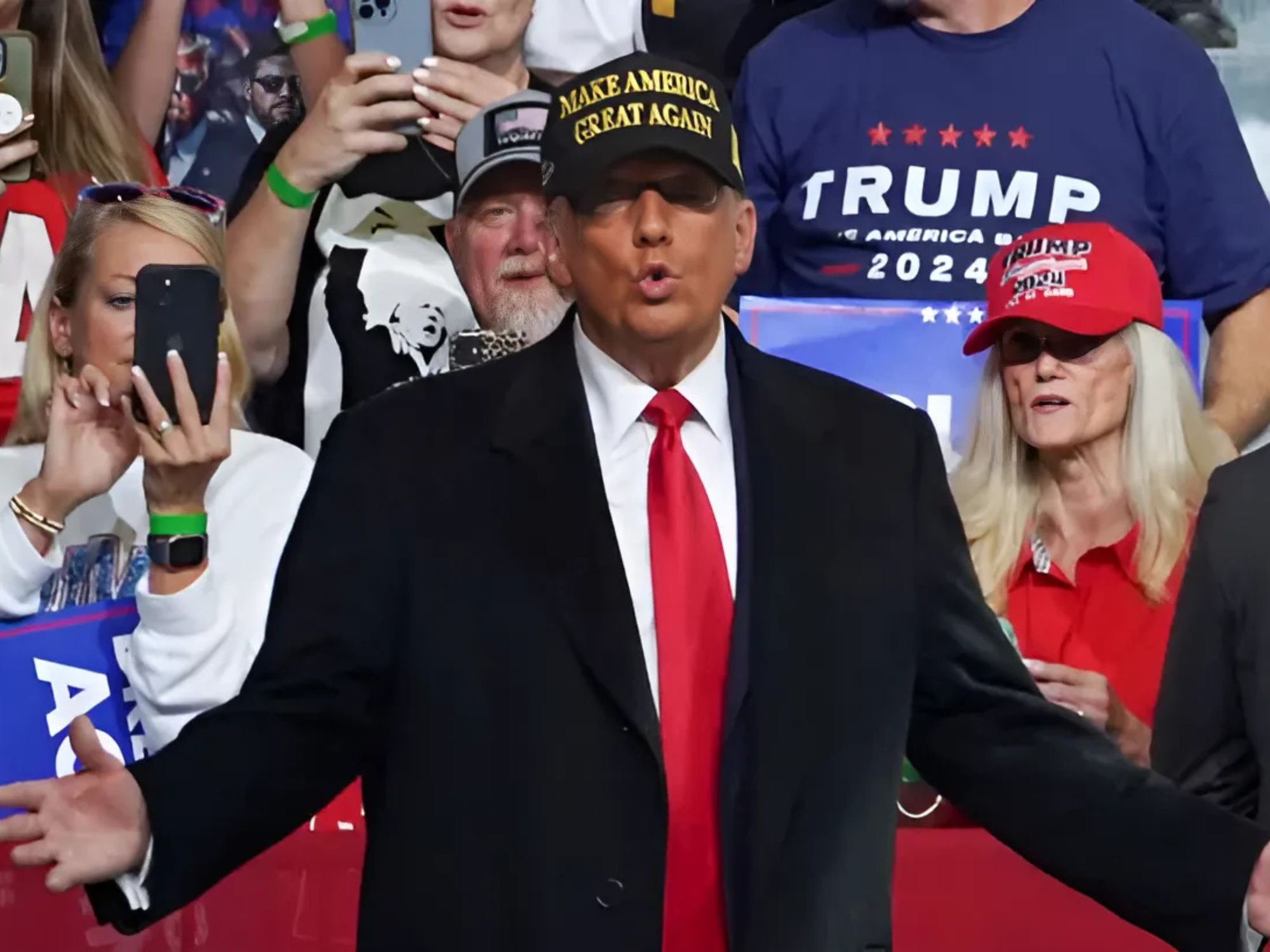

The election, marked by a tense campaign disrupted by security incidents and Biden’s withdrawal in favor of Kamala Harris, has left financial markets on edge. Investors are particularly watchful of how a Trump win could impact inflation through his protectionist trade policies, potentially affecting U.S. exports.

Image Source: Reuters

Image Source: Al Jazeera

Reflecting the heightened uncertainty, implied volatility on the yuan hit record levels against the dollar, given China’s susceptibility to trade tensions. The yuan traded at 7.1065 per dollar, while broader foreign exchange markets remained steady.

Analysts at J.P. Morgan summarized the stakes, suggesting, “Ultimately, the U.S. election comes down to this – a vote for economic continuity and stability with Harris or a shift toward protectionist policies and strongman governance with Trump.”

In Australia, traders awaited a rate decision from the Reserve Bank, expected to leave policy unchanged, while the Australian dollar held at USD 0.6590. Treasury yields inched up, with 10-year yields at 4.30%.

As results begin to emerge after midnight GMT, focus will turn to battleground states including Georgia, Michigan, and Pennsylvania. With a winner potentially undecided for days, Trump has indicated he may contest any loss, repeating a stance from the 2020 election.

Other News

Boeing Workers Vote on Wage Deal to End Strike

Boeing’s West Coast factory workers are voting on a new contract offering a 38% pay raise over four years, potentially ending a seven-week strike. If approved, production of key jets could resume as early as Wednesday.

U.S. Banks Offer Paid Time Off to Encourage Voting

JPMorgan, Bank of America, and Citigroup are reminding U.S. employees of paid time off policies to vote in Tuesday’s presidential election, encouraging civic participation across political divides.

China’s Services Sector Grows as Stimulus Takes Effect

China’s services PMI rose to 52.0 in October, the fastest growth in three months, as Beijing’s stimulus measures improved business conditions. New business and employment increased.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.