Today’s News

Image Source: Reuters

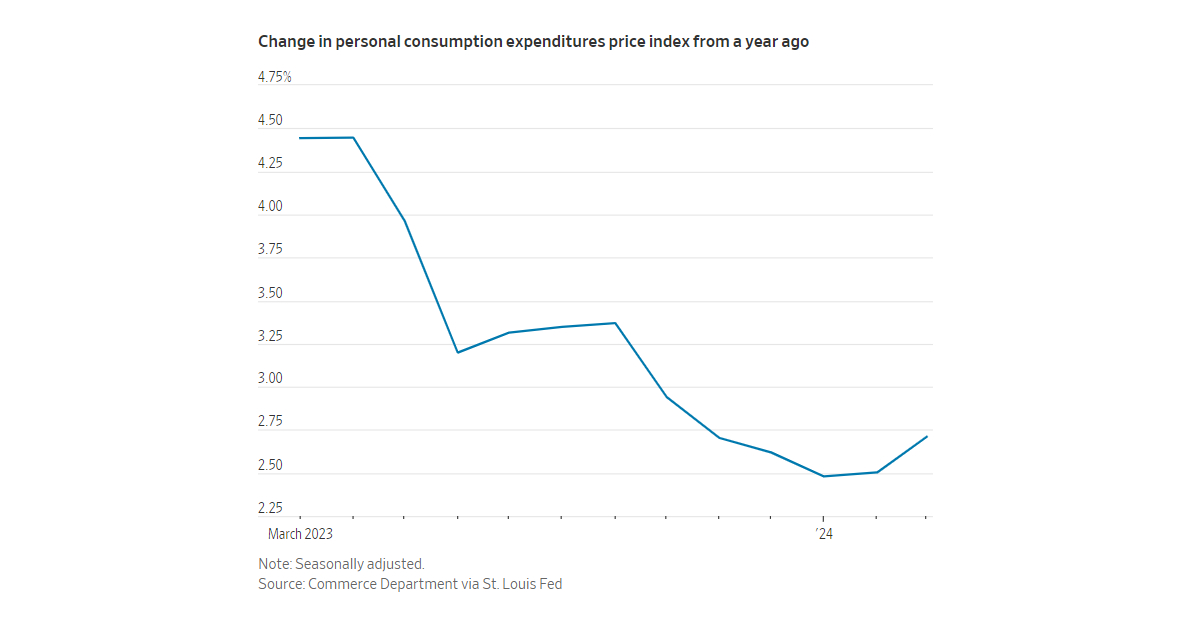

Recent surges in Treasury yields are unsettling stock-market gains as signs of persistent inflation drive long-term interest rates to their highest levels of the year. Treasury yields reached new highs for 2024 in the past week following the release of fresh data indicating persistent inflation.

Initially, Wall Street traders anticipated the Federal Reserve to implement multiple rate cuts throughout the year. However, expectations have shifted drastically, with only one rate cut now priced in. The yield on the benchmark 10-year note, which moves inversely to bond prices, has risen by nearly a percentage point from its February lows, settling at 4.668% by the end of Friday.

“Markets were overzealous to say the least about the Fed cutting in March and cutting six times this year,” said Rick Rieder, chief investment officer of global fixed income at USD 10.5 trillion asset manager BlackRock. “Now there’s been a complete reworking of that thought process, and when you go through that you get markets that are very jumpy looking for the next piece of information.”

Looking ahead, the focus shifts to upcoming Federal Reserve discussions on rates, alongside key economic indicators such as the Friday jobs report. Meanwhile, the Treasury Department’s imminent release of its quarterly borrowing plan promises insight into the government’s fiscal strategy.

Despite earlier resilience to climbing yields bolstered by robust economic fundamentals, concerns loom over stretched stock valuations amidst slowing growth and inflationary pressures.

“Equities have been able to withstand stronger yields because it was predicated on a stronger economy,” said Steve Sosnick, chief strategist at Interactive Brokers. “This looks more worrisome. If inflation spooks the bond market further, that will be problematic.”

However, challenges persist, notably in the bond market, where heightened issuance of new debt raises worries about market absorption capacity. The volatility triggered by recent events underscores the cautious sentiment prevalent among investors, with uncertainty prevailing over short-term yield fluctuations.

“My sense is by the end of the year these rates will come down, but in the near term, people are cautious. There’s a tremendous amount of uncertainty,” Rieder said.

Other News

Western Banks Pay EUR 800M Taxes Amid Russia Profits Surge

Western banks in Russia paid over EUR 800 million (USD 857M) in taxes last year, a fourfold increase from prewar levels, despite reducing exposure post-Ukraine invasion. Profits surged, partly from trapped funds, amid sanctions.

AIA Boosts Shareholder Returns on Record New Business Value

AIA Group achieved record new business value in the first quarter, prompting the insurer to increase shareholder returns and expand its share buyback program to USD 12.0 billion from USD 10.0 billion, fueled by its robust financial position.

Deutsche Bank Mulls Settlement in Postbank Takeover Litigation

Deutsche Bank is considering options for settling litigation related to its takeover of Postbank, potentially involving claims of up to 1.3 billion euros. This follows a court hearing indicating possible validity of claims, impacting on the bank’s earnings.