Today’s News

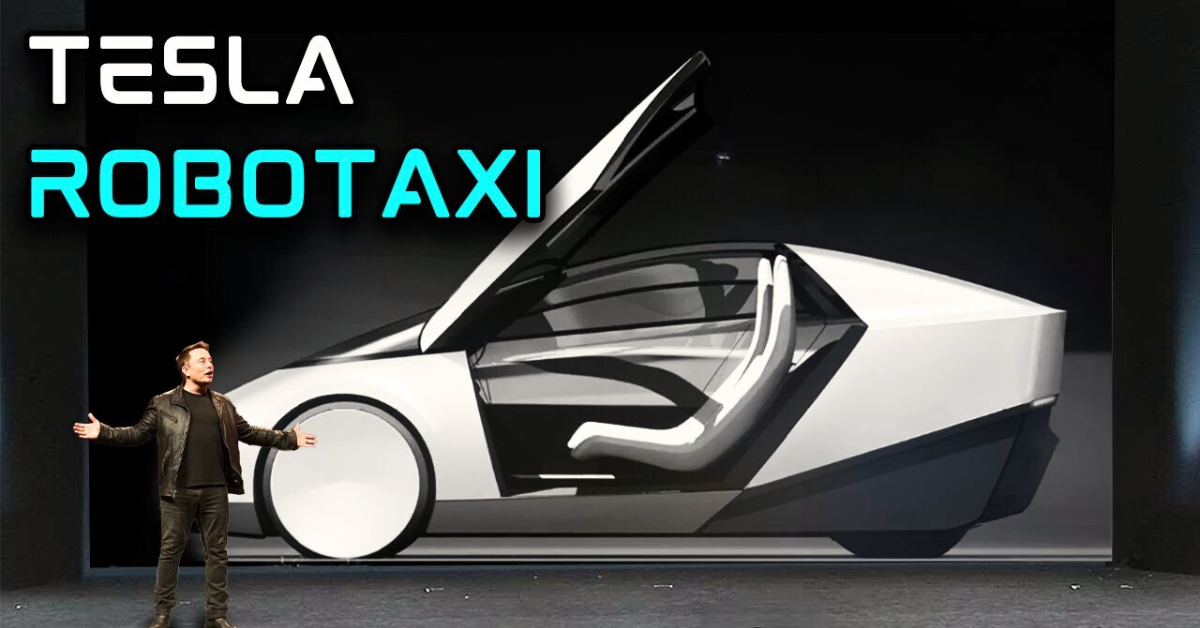

Tesla surprised investors on Wednesday with a stronger-than-expected forecast for vehicle sales growth and record-low production costs, leading to a 12% surge in its stock price. CEO Elon Musk projected sales to increase by 20% to 30% next year, easing concerns over the company’s core electric vehicle business and downplaying worries about its timeline for producing a robotaxi.

Image Source: AI Uncovered

This upbeat forecast, which followed an earlier target for “slight growth” in 2024 deliveries, helped boost Tesla’s market value by roughly USD 80 billion in post-market trading. Musk’s comments reassured investors that Tesla is focused on maintaining its industry-leading profit margins while reducing the cost of producing its cars.

Tesla’s third-quarter earnings report showed that the company’s cost of making vehicles dropped to a record low of about USD 35,100 per unit. This improvement contributed to a rise in the profit margin from vehicle sales, excluding regulatory credits, which reached 17.05%, beating Wall Street’s expectations of 14.9%. Adjusted earnings for the third quarter were USD 0.72 per share, exceeding the forecasted USD 0.58 per share.

Musk emphasized Tesla’s profitability in a challenging environment, stating, “No EV company is even profitable.” He highlighted Tesla’s ability to remain profitable while other automakers’ electric vehicle divisions struggle.

Driverless Vehicles on the Horizon as Tesla Faces Margin Challenges

The company also revealed plans to roll out driverless vehicles offering paid rides by next year, pending regulatory approval in California and Texas. Meanwhile, sales of Tesla’s Full Self-Driving (FSD) software saw a significant boost following the company’s robotaxi event earlier in the month.

Despite these positive developments, Tesla’s CFO Vaibhav Taneja cautioned that maintaining current profit margins in the fourth quarter would be challenging. Nevertheless, the company continues to benefit from declining raw material costs for electric vehicle batteries, with these savings expected to diminish over time.

Tesla Eyes Record Deliveries Amid Strong Regulatory Credit Revenue and Optimized Profit Margins

Tesla has already delivered 1.29 million vehicles this year and needs to deliver another 514,925 to surpass last year’s record. The company also reported its second-highest quarter of revenue from regulatory credits, which grew 33% year-over-year to USD 739 million, although this was down from USD 890 million in the previous quarter.

Investors welcomed the positive earnings, viewing the improving profit margins as a sign that Tesla is balancing pricing and production costs effectively. Senior analyst Thomas Monteiro from Investing.com noted, “The improving numbers across the board signal the company may have finally found a nice sweet spot for the pricing-versus-production-costs equation.”

Other News

Wall Street Falls on Tech Losses, Rising Yields

Wall Street closed lower as rising Treasury yields pressured tech stocks like Nvidia and Apple. McDonald’s shares dropped 5% following an E. coli outbreak.

IBM Misses Q3 Revenue Estimates, Shares Drop 4%

IBM’s third-quarter revenue missed estimates, driven by weakness in consulting as businesses cut discretionary spending, causing shares to drop 4%.

Yuan Faces Pressure as Trump Trade Tariff Threats Loom

The yuan is under pressure as Trump’s potential return raises fears of new tariffs, with exporters hoarding dollars and the currency down 2%.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.