With the advancement of science and technology in recent years, financial technology has reached a new high. As a result, more and more online brokers are coming into existence.

Doo Prime stands out among many brokerages with its safe and convenient trading platform and high-quality investment environment, trusted by clients worldwide. In recent years, Doo Prime has established bilateral partnerships with a number of important financial institutions, gaining international recognition and laying a leading position in the industry.

Doo Prime cooperates with a number of large banks to achieve strict capital custody

Doo Prime’s dedication in providing a trading environment that prioritizes clients’ peace of mind is one of the important factors in our success.

In terms of capital protection, Doo Prime has:

- achieved independent custody of client assets;

- strictly segregated customer funds from company funds in accordance with regulatory requirements;

- depositing the funds in Standard Chartered, Bison Bank, and Barclays, to fully protect the rights and interests of the customers.

In addition, Doo Prime’s parent company, Doo Group has signed a memorandum of understanding with Bison Bank in May 2021 to promote cooperation arrangements on wealth management services and financial products to international clients. Working together in harmonious synergy, we aim to strengthen the influence of our businesses in different countries and regions to meet new opportunities under the accelerated development of global fintech.

Doo Prime secures the renewal of the VFSC license

Doo Prime has successfully renewed its financial dealer’s license issued by the Vanuatu Financial Services Commission (VFSC) in June 2021 to continue expanding international relations, and seize the global financial market.

Vanuatu is one of the offshore financial centers in the Southwest Pacific Ocean region, attracting attention of different companies across the globe. In terms of legal standards, the VFSC financial license has been in line with the EU and other regulations, prompting it to be a gradual new drift in industry regulation.

In 2021, the VFSC adopted a more stringent approach in approving and renewing all financial services licenses in an attempt to create a stricter investment environment. The certified companies are required to have a local office and employ local directors and a compliance officer, anti-money laundering officer, and audited by a third-party audit firm.

Under the new regulation, the VSFC has screened over 400 existing companies, and the number of financial services licenses has been reduced to 124. Doo Prime broke through with its excellent qualifications, was recognized by Vanuatu regulators and had its license successfully renewed. This is a reflection of how the company’s operating standards are recognized and trusted by the international market and clients.

In addition, Doo Prime’s parent company, Doo Group, has also obtained regulatory licenses from multiple countries. Currently, Doo Group has been strictly regulated by a number of financial regulators around the world, which include the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), the Financial Conduct Authority (FCA) in the United Kingdom, VFSC, and the Mauritius Financial Services Commission (MFSC).

As an internationally renowned online broker, Doo Prime adheres to the principle of ’customer first’ while achieving excellent regulatory qualifications, to create an efficient and reliable online trading environment to protect the safety of customers’ funds and safeguard their rights and interests.

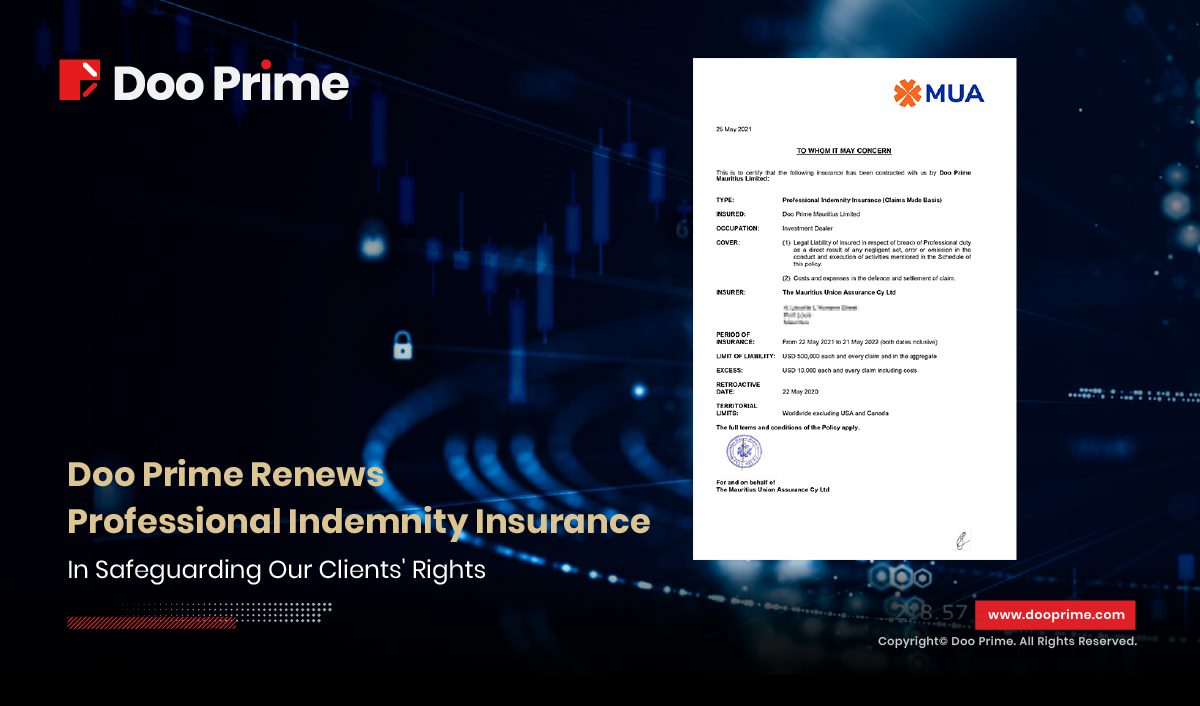

Protecting clients’ funds under PII

In May 2021, Doo Prime renewed the Professional Indemnity Insurance (PII). The PII is based on internationally applicable standards of practice, knowledge, and professional ethics. It is designed to distinguish licensed professionals from other unregulated entities.

The professional policy continues to protect the rights and interests of Doo Prime’s clients, with a guaranteed amount of up to US$500,000. In addition, it also covers any loss or damage caused by Doo Prime to clients, ensuring that clients’ assets will not be misappropriated or stolen. Renewal of the PII essentially helps to provide clients with a secure and stable trading environment and broker services, along with reliable capital protection.

Doo Prime sets sail for successful globalization

Aware of the new opportunities presented by the international market in recent years, Doo Prime has been looking to explore the overseas markets, establish good reputation, and expand the ”Doo” brand to a wider range of regions.

During the first half of 2021, Doo Prime and its parent company Doo Group have achieved a number of impressive results. These successes have reflected the company’s constant improvement in its operation, and gained the recognition and trust of clients, as well as won a prominent position in the industry.

Behind the brilliant results of Doo Prime lies our core value of prioritizing the interests of clients. As an industry-leading online broker, Doo Prime has been committed to providing clients with safe, reliable, and convenient global financial asset investment services, as well as creating a top-notch quality trading experience.

About Doo Prime

Doo Prime is an international pre-eminent online broker under Doo Group with operation centers in Dallas, Dubai, Hong Kong, Kuala Lumpur, Singapore, and other regions. Our main ethos is to provide professional investors with global financial instruments (CFDs) on our trading platform.

Doo Prime holds the financial regulatory licenses in Mauritius and Vanuatu, which have granted us the opportunity to deliver the finest trading experience to more than 30,000 professional clients, with more than 5 million trading orders executed every month.

By the virtue of robust technological innovation put forward by the group, Doo Prime has achieved seamless connection with the global trading market, providing thousands of CFD products on multiple trading terminals, such as MT4, MT5, TradingView, Doo Prime InTrade, and more, covering Forex, Precious Metal, Securities, Futures, Commodities, and Stock Indices, allowing clients to invest globally with one click.

With a solid vigorous group background, competitive trading cost, convenient deposit and withdrawal methods, plus 24/7 multilingual customer service, Doo Prime is committed to become your private veteran broker.

For more information, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – China: +86 400 842 7539

E-mail:

Technical Support: en.support@dooprime.com

Sales Representative: en.sales@dooprime.com

“Forward-looking” Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology, such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Group will be generally assumed as forward-looking statements.

Doo Group has provided these forward-looking statements based on all current information available to Doo Group and Doo Group’s current expectations, assumptions, estimates, and projections. While Doo Group believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Group’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Group does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Group is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.