President Donald Trump has announced a sweeping new “reciprocal tariffs” policy targeting countries around the world—far exceeding market expectations. This move marks a major shift in US trade strategy and signals a restructuring of global trade dynamics.

The announcement sent shockwaves through financial markets, prompting immediate and intense reactions. Here’s what you need to know about the new tariffs and how they could shape financial markets heading into 2025.

What’s in Trump’s New Tariff Policy?

On April 2, Trump unveiled a new tariff framework targeting global trade imbalances. Key measures include:

- A universal 10% tariff on imports from all countries, effective April 5 at 12:01 a.m.

- Customized tariffs ranging from 10% to 49% on countries with the largest trade surpluses with the US, effective April 9. Other nations remain under the 10% baseline.

- A 25% tariff on all imported vehicles, effective immediately.

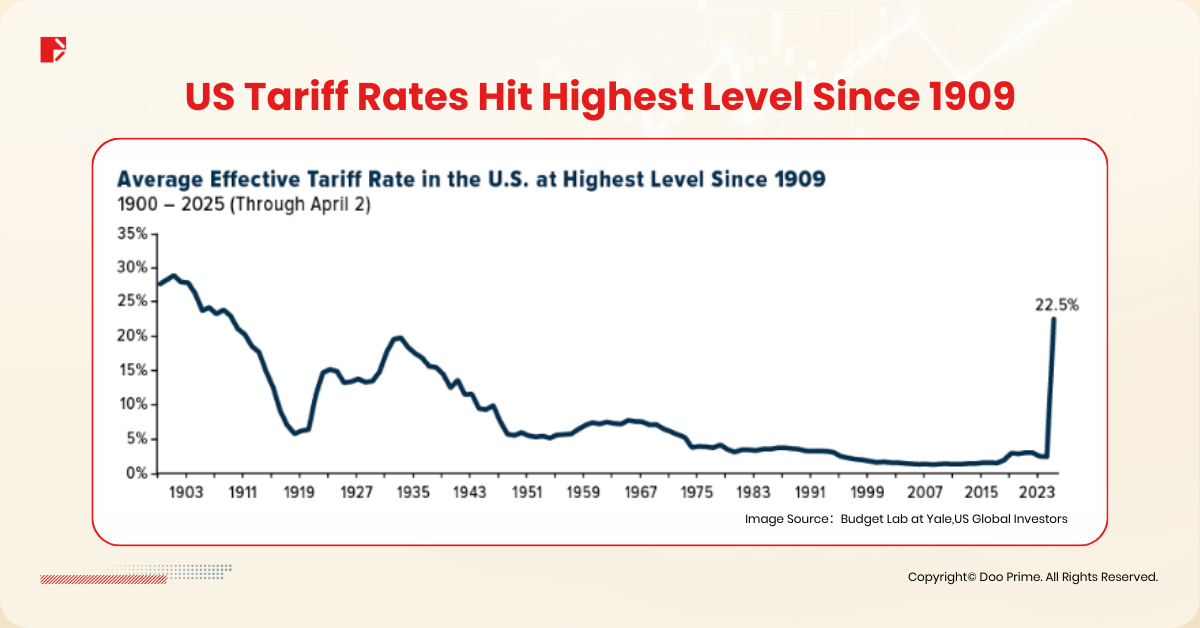

According to research from Yale University, this raises the average effective US tariff rate to 22.5%, the highest since 1909—more than double the expected 10%.

What’s Driving Trump’s Tariffs Push?

Trump’s tariff policy is built on three main goals:

- Fixing trade imbalances: The aim is to counter what Trump calls “unfair trade practices” and bring manufacturing jobs back to the US.

- Boosting US employment: By making American-made products more competitive, the administration hopes to stimulate industrial growth and job creation.

- Raising federal revenue: Higher tariffs mean more income for the government, helping support the federal budget.

Market Reaction: Immediate and Intense

The market response was swift and severe following the announcement.

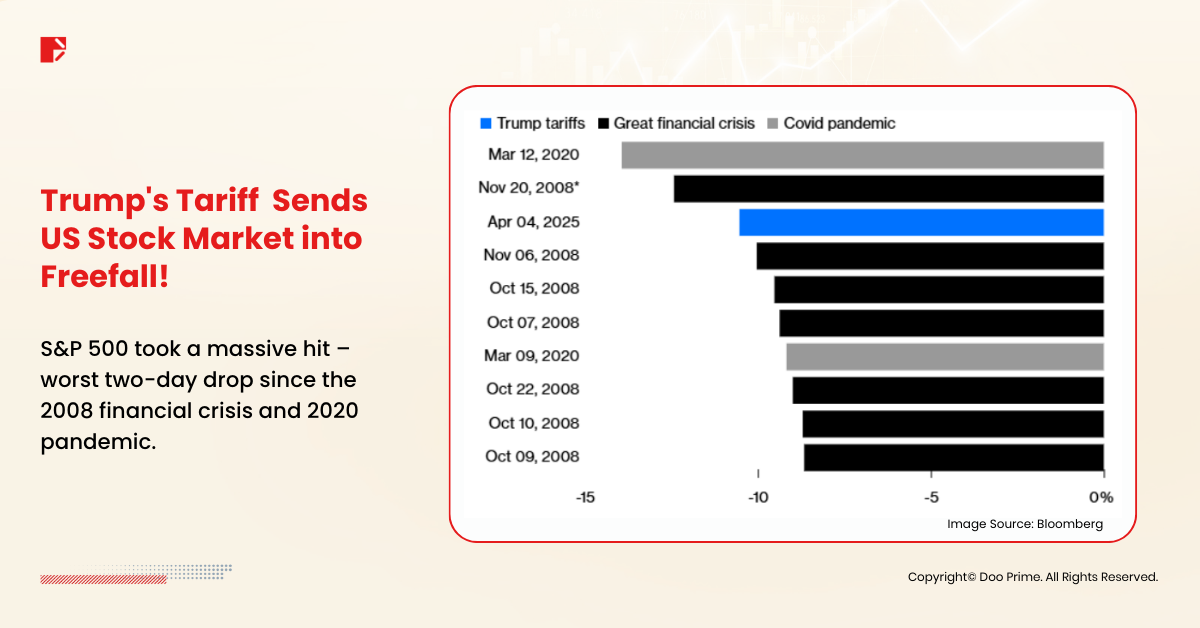

Stock Markets Tank

- On April 3, the Dow Jones, S&P 500, and Nasdaq all posted their biggest single-day drops in years.

- The sell-off continued on April 4, with the S&P 500 plunging 5.97%, the steepest drop since March 2020.

Dollar Weakens

- The US Dollar Index fell from over 104 to below 102 in a day, lifting other major currencies in response.

Commodities Slide

- Gold spiked to nearly $3,200/oz before retreating as capital shifted to other safe havens.

- Oil dropped more than 4% as fears of slowed global trade dragged down energy demand.

Who’s Hit Hardest by the New Tariffs?

Consumer Goods

The tariff hikes hit a wide range of consumer products. Many companies had already shifted production to countries like Vietnam and Thailand to avoid previous tariffs—only to find these nations now on the high-tariff list too.

Brands like Nike and Adidas saw their stock prices drop nearly 10% after the announcement.

Auto Industry

Foreign automakers face a brutal 25% tariff on US imports. Luxury brands like BMW and Mercedes-Benz are especially vulnerable, with import costs on some models rising by up to $20,000 per vehicle.

What Should Investors Watch in the Short Term?

Will Tariffs Be Negotiated Down?

US Treasury Secretary Vincent Besson said the April 2 tariff plan represents a “ceiling”, suggesting there’s room for negotiation. Over the next few weeks, discussions between the US and trade partners will be critical. Any signs of compromise could ease market fears.

On April 9, Trump announced a temporary rollback of new tariffs, reducing rates to 10% on imports from most US trade partners. The pause will last 90 days to allow room for trade negotiations.

Over the next three months, talks aimed at lowering actual tariff levels are expected to take center stage, with outcomes likely to influence global market sentiment.

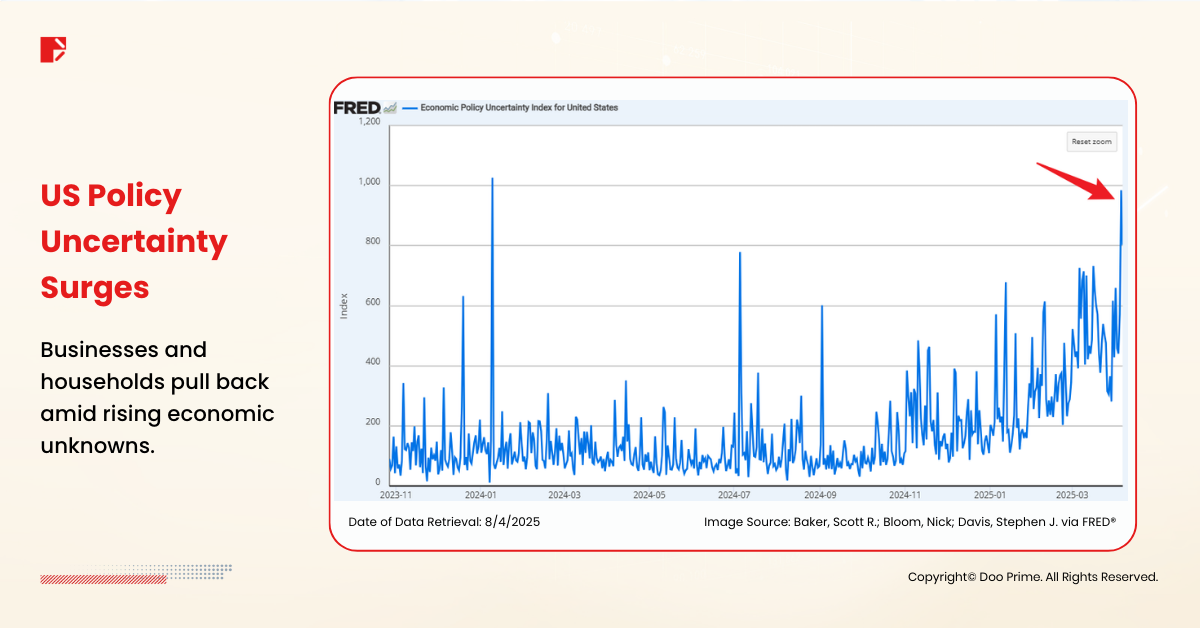

Rising Economic Policy Uncertainty

Following the announcement, the US Economic Policy Uncertainty Index spiked. When policies are unpredictable, businesses tend to hold back on investments. This has fed growing concerns that the US economy could slide into recession later this year.

How Will the Fed Respond?

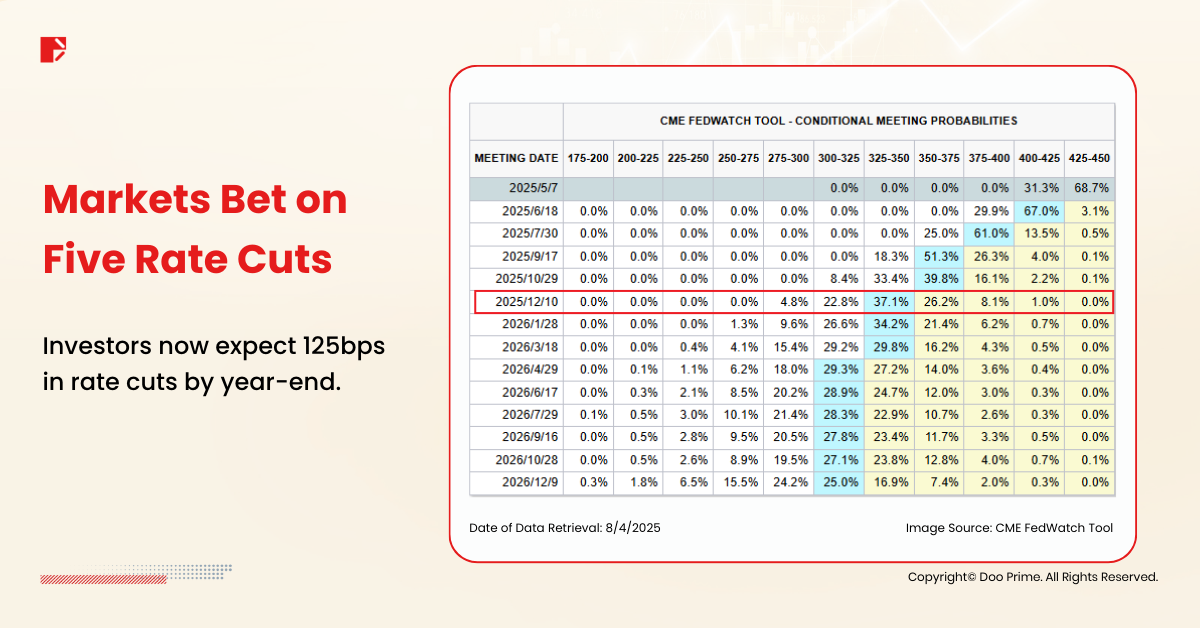

Amid rising fears of a global slowdown, markets had priced in as many as five Federal Reserve rate cuts in 2025—totaling 125 basis points—with some speculating the Fed could act even before its next scheduled meeting.

However, following Trump’s decision to delay full enforcement of reciprocal tariffs, expectations for aggressive rate cuts have eased. Still, rate forecasts remain volatile, highlighting just how quickly market sentiment can shift.

Investment Landscape Amid Tariffs Volatility

Long-Term Market Dynamics

Trump has made it clear that tariffs are a cornerstone of his economic agenda—and they’re likely to stay. This means ongoing volatility in global trade negotiations will continue to impact the markets.

Long-term investors need to factor this in when making allocation decisions. Every new tariff development or diplomatic breakthrough can trigger sector-wide ripples.

Short-Term Market Sensitivity

Since the April 2 announcement, short-term volatility has intensified. On April 8, a rumor suggesting a delay in tariff implementation triggered a brief surge in stock prices—followed by a sharp reversal once the news was proven false.

Episodes like this underscore the sensitivity of markets to policy-related headlines. Fluctuations in pricing and sentiment may persist as additional developments unfold in the coming months.

Final Takeaway: Global Trade Talks and Market Sentiment

The coming months will determine whether countries can negotiate their way out of steep tariffs. Global trade talks will directly shape market sentiment and investor confidence.

For now, the key is agility—keeping an eye on global policy shifts and being ready to pivot your portfolio to manage risk and seize new opportunities.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of the information provided and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

Do not rely on the above content to replace your independent judgment. You should consider the appropriateness of this information having regard to your personal circumstances before making any investment decisions. The market is risky, and investments should be made with caution.

© 2025 Doo Prime. All Rights Reserved.